What we do

Combined, the OnMarket team has over 140 years’ experience in the Australian capital raising market. We know that raising capital can be a difficult process, particularly for early stage and/or smaller companies. We work to make raising equity efficient, simple and transparent for both companies and investors.

Why we are different

Helping companies at all stages of growth

We assist both listed and unlisted companies through all aspects of capital raising, from seed, Series A and Equity Crowdfunding (ECF), to IPOs through to follow-on placements. We do this by combining our deep capital markets and advisory experience with our proprietary capital raising platform.

Leading proprietary platform

The OnMarket platform has been built to improve capital raising efficiency and access to capital at scale. Our distribution, payment and allocation processes are fully automated. In our largest capital raise by number of investors, OnMarket processed more than 15,000 individual applications in a month. This remains the largest Equity Crowdfunding deal in the world by number of investors. At the other end of the scale, we have helped founders raise funds from a select group of high net worth and strategic investors.

Broad network with access to capital

We regularly partner with industry-colleagues such as investment funds, brokers and specialist advisers to help companies access all types of capital, in addition to our +50,000-member database.

Deep experience

Our founding team members have over 140 years of capital markets, advisory and investing experience, with backgrounds spanning investment banking, private equity, law, regulation and corporate advisory.

The founding team are all still with the business today, from our beginnings as a joint venture with ASX, to pivoting as a B2C retail focused platform. We’ve gone on to become one of the first platforms to be granted a crowd-sourced funding licence and closing the first Equity Crowdfunding (ECF) deal in Australia, whilst continuing to advise companies raising wholesale capital.

In addition to raising capital for companies, our team has the unique insight of founding and scaling our own business as a growing fintech, as well as advising and engaging with investors.

Our services

IPO

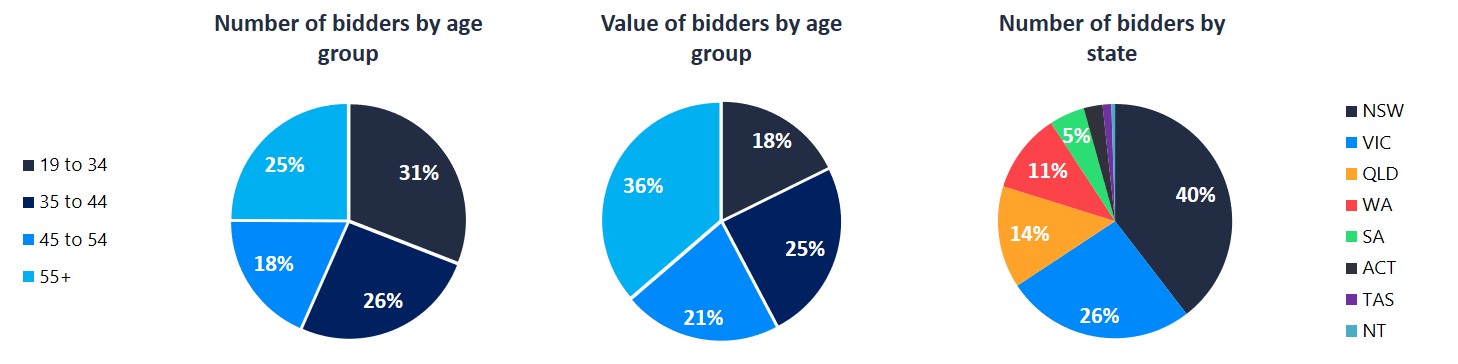

We have participated in over 200 IPOs alongside lead managers to assist with shareholder spread, broad investor distribution and capital. Our members are typically self-directed and independent, representing all demographics across the country.

We also act as an independent advisor to companies that wish to IPO, including introductions to lead managers, brokers, cornerstone investors and specialist advisors (eg accounting, tax).

Equity Crowdfunding (ECF)

We help unlisted companies raise equity capital from all types of investors under the Crowd-sourced funding regime. ECF offers a way for companies to activate their own network of followers by allowing them to invest in the company they support - encouraging brand advocacy, customer acquisition and engagement. It is also an opportunity to engage with new audiences via social media and through our database of + 50,000 members.

OnMarket has conducted successful ECF raises for a variety of growing businesses and we have used this experience to refine our ECF methodology to what is now, a highly streamlined and efficient process.

We look forward to talking with you about the opportunities that ECF can provide. In the meantime, you can read more about ECF here.

Wholesale raises

For unlisted companies that don’t meet the crowd-sourced funding eligability requirements or who would prefer not to publicly market their offer, OnMarket has a loyal group of sophisticated, experienced and professional investors. This group are members of our Capital Club. We also assist companies that wish to engage with strategic or high net worth investors within our network.

In addition, there are a number of ways we can approach a bespoke raising such as opening up a private deal room for you to manage your capital raise, using our infrastructure, payments portal and trust account.

Advisory

Our team has the depth and experience to provide full advisory services spanning:

- offer document preparation (pitch documents, information memoranda, investor presentations, ECF offer documents, prospectuses, offer information statements etc)

- valuation

- constituent shareholder documents

- marketing an equity offer (including advice on PR, social, video and events)

- M&A

- corporate actions (eg share split, shareholder voting etc)

- corporate structuring

- directors’ duties and corporate governance

- government programs for grants and funding

- independent advice and negotiating with investors on your behalf (including investor due diligence and transaction structuring)

- how to manage your cap table

- investor communications