Blog

Case Study: OnMarket closes equity crowdfunding offer for advanced Artificial Intelligence technology company

13 Jan 2020OnMarket has successfully completed the Ecocentric equity crowdfunding campaign raising $477,000. Ecocentric is a deep tech business with Artificial Intelligence technology designed to make our buildings safer, more productive and more sustainable.

Numen: Artificial Intelligence at the forefront of the energy data revolution

06 Dec 2019According to McKinsey, linking the physical and digital worlds could generate US$11.1 trillion a year by 2025. Ecocentric has developed Numen, Artifical intelligence making our machines and buildings safer, more efficient and more sustainable.

The world's buildings are old, unsafe and inefficient

28 Nov 2019In April this year, the 856-year-old Notre Dame de Paris cathedral burst into flames with a malfunctioning electrical system has been suggested as a possible cause. But what is being done to prevent this happening to buidlings all over the world?

Case Study: OnMarket closes equity crowdfunding offer for transformational mental health diagnostic technology

18 Nov 2019OnMarket has successfully completed the NeuralDx (NDX) equity crowdfunding campaign raising $366,338 from 172 investors. NeuralDx is commercialising a revolutionary neurological diagnostic technology.

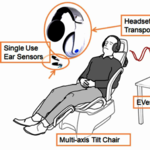

A transformational technology for the diagnosis of mental and neurological disorders

23 Oct 2019There are currently no objective tests or methodologies to diagnose mental disorders, resulting in delay and misdiagnosis which has serious consequences for the sufferer and the community. NeuralDx has a vision where mental health disorders are to accurately diagnosed, treated and monitored for a better world.

The global impact of mental health disorders

17 Oct 2019Mental health is becoming more and more prominent and is now classified as the world’s number 1 non-communicable health issue. Who does it impact and what are the consequences?

2019: The year of the OnMarket IPO (so far)

16 Oct 2019Will Donald Trump ever end his trade war? Will Britain actually leave the EU? Is quantitative easing really a solution? How have OnMarket IPOs performed in 2019? Politics and macro-economics isn’t our forte, but capital raising is and this year has been outstanding for OnMarket IPOs returning an average of 57%.

"Trip Advisor for baby products" completes $5.5m funding round

11 Sep 2019Having successfully completed a $5.5m capital raise to help them expand their baby product review and e-commerce platform into China, Tell Me Media recently featured in the Australian Financial Review to discuss their raise and plans for the future.

Case Study: OnMarket closes equity crowdfunding offer for the world's first Vitamin D promoting SPF technology

23 May 2019OnMarket has successfully completed the Solar D equity crowdfunding campaign. Solar D is a company that licences Vitamin D promoting SPF technology. Solar D is the first to market with a new technology that aims to tackle the global issue of Vitamin D deficiency.

How much money have OnMarket investors made from IPOs?

03 May 2019In January 2018, I wrote a blog outlining a simple strategy that had produced pretty amazing returns over the previous 4 years. Recently, I spent a bit of time in the bush with no internet or TV. It got me thinking, how has it gone for the people that read the blog and started the strategy at that point in time?

How is the Solar D sunscreen technology different to every other sunscreen?

27 Apr 2019Solar D was specifically designed to let in more of the UVB light so our bodies can produce more vitamin D without sacrificing the Sun Protection Factor (SPF).

Vitamin D is important in maintaining good wellbeing, however, it is important that sun protection is not sacrificed in order to achieve our required vitamin D levels. No other sunscreen has been able to create this technology.

Why is Vitamin D so important?

17 Apr 2019It’s estimated that there are over 1 billion people worldwide that are considered vitamin D deficient. Even in Australia, despite the abundance of sunshine, studies show that over one third of Australians are vitamin D deficient.

Does your Sunscreen Inhibit Vitamin D Production?

12 Apr 2019Since the inception of sunscreen in 1938 by Franz Grieter and the invention of water-resistant sunscreen in 1977, sunscreen technology hasn’t really changed. Traditional sunscreens screen out almost all the ultra violet (UV) light. However, recent studies have shown that not all UV light is equal. In fact, some of the sun’s UV light can be beneficial for our health.

Case Study: OnMarket closes equity crowdfunding offer for sustainable, technology-enabled coffee cup service

01 Mar 2019OnMarket has successfully closed its fifth equity crowdfunding offer with The Cup Exchange, raising $776K from 284 investors.

The average IPO was up 8% one month after listing in 2018

Posted by OnMarket 31 Jan 2019In 2018 the average IPO was 11% higher at the close of the first day than the issue price. The 95 IPOs that listed in 2018 were up, on average, 8% one month after their respective listing dates.

OnMarket presenting at Emergence 2019 conference in Brisbane and Sydney

30 Jan 2019OnMarket will be presenting on capital raising, specifically equity crowdfunding, at this year’s conferences in Brisbane and Sydney.

The Cup eXchange story and how it works

Posted by OnMarket 26 Nov 2018Like many Australians, in mid-2017 Marty and Jeremy Rowell watched the ABC’s The War On Waste and were perplexed in particular by the size of the take-away coffee cup waste problem and the lack of a genuine mass-market solution. Feeling inspired, the brothers set out to buck the trend of the “take – make – and dispose” linear economic model.

The Brothers behind Australia's single-use coffee cup solution

Posted by OnMarket 19 Nov 2018Australians collectively send an estimated 1.2 billion single-use paper coffee cups to landfill every year. The ‘keep cup’ seems to have made only a minimal difference to this number. We interview brothers Marty & Jeremy Rowell, the inventors of The Cup eXchange, Australia’s single use coffee cup solution.

Case Study: OnMarket closes equity crowdfunding for peer-to-peer digital gold money platform, SendGold

24 Oct 2018OnMarket has successfully closed the equity crowdfunding offer for SendGold, raising $503K from 393 investors.

SendGold is our fourth successful equity crowdfunding raise for 2018 and follows the successes of Revvies, DC Power Co. and PT Blink.

7 essential tips for equity crowdfunding success

Posted by OnMarket 23 Oct 2018There is plenty of advice handed out when you first decide to undertake an equity crowdfunding raise…….you must have a strong and engaged crowd of customers and supporters, a unique product that will grab attention, and a powerful marketing strategy that is going to convert those who are interested in your company into investors.

100 transactions in 1,000 days for +100% annual returns

Posted by OnMarket 25 Sep 2018We have recently completed our 100th transaction. OnMarket launched its B2C platform in October 2015, approximately 1,000 days ago. OnMarket, which is now approaching 50,000 members, provides retail investors with access to over one third of all IPOs on the ASX.

Crowdfunding now open to Australian proprietary companies

Posted by OnMarket 20 Sep 2018For proprietary companies, the wait is over to take advantage of the equity crowdfunding movement. An amendment to the 2017 equity crowdfunding legislation was passed in Federal Parliament last week allowing private Australian companies to raise capital through equity crowdfunding.

Can Venture Capital, Angel Investment and Equity Crowdfunding co-exist?

31 August 2018 @ 8:00amAlternative non-VC sources of financing are growing rapidly and giving entrepreneurs many more choices than in the past. But can they co-exist? Let’s look at a couple of different options to venture capital.

"Anti-banks" emerge as Australia hits "peak banking bad"

Posted by OnMarket 31 Aug 2018The golden era is well and truly over for Australia’s major banks. After decades of dominating the nation’s finance sector, their long-held position of power is under threat. Anti-bank sentiment among consumers is widespread, and innovative new competitors are offering alternatives to the traditional banking system.

Digital gold the new game in town

Posted by OnMarket 29 Aug 2018Imagine if all those virtual gold bars and coins you accumulate while video gaming suddenly became real gold.