Waiting for the right one? Sector and Performance breakdown

Posted by Ben Bucknell 18 January 2018 @ 5:28pm IPOs

Well, back to the office and a new year beckons… oh, that sounds so much more chipper than I feel today. I’m going to wrap up this summer series in the next couple of days, but before I do, there’s a few more bits of analysis that I hope you’ll find interesting.

Let’s say you haven’t been one of the people investing in IPOs yet? You’re probably waiting for the right one, right? We hear that from time to time.

So, here’s the breakdown of sectors that we’ve offered you IPOs since we launched:

Sector breakdown of OnMarket IPOs

That’s a pretty diversified selection…so, if you are still waiting…well, what to say? Or perhaps you are waiting for some historical figures to prove up the proposition that investing in IPOs is a good idea..

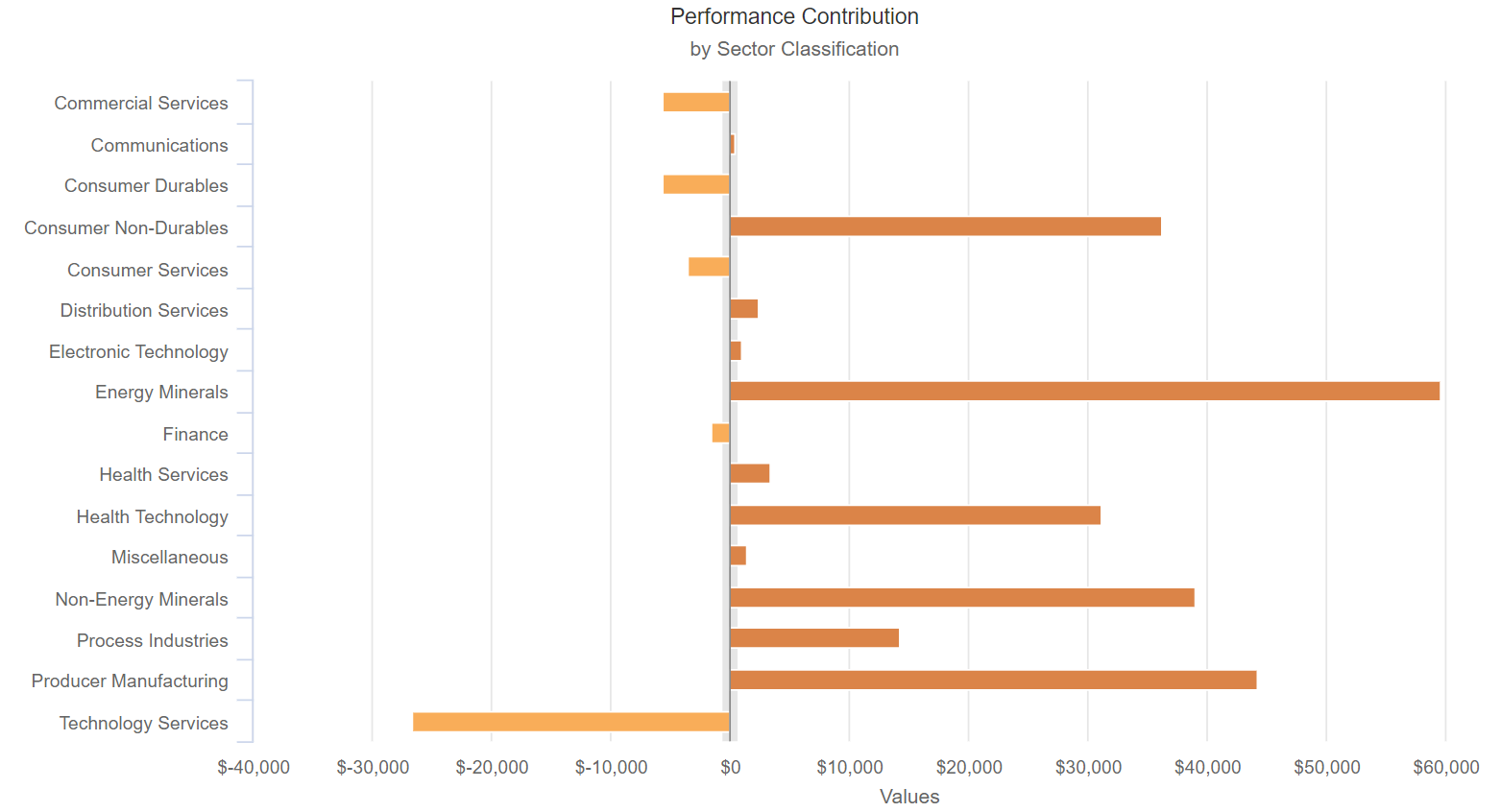

So, which sectors have contributed the most to performance, and which have been the duds?

Contributions to profit - selling 6 months after listing based on $10,000 investment

See the trend? Nope me neither. And, I get it…after all, no-one likes to lose money, and the minimum investment in an IPO is $2,000 (that’s one reason why we’re bringing you equity crowdfunding…but more on that later).

But, the interesting thing about the last 24 months is that you didn’t have to ‘pick winners’… if you didn’t see our article on a diversified portfolio that yielded a money-weighted return over the past 4 years of +50% per annum, then read about it here.

Lots of people ask about our predictions for 2018. Well, I reckon crystal ball gazing should be left to the experts. I’m a Virgo by the way. No, seriously, if you want some research on trends for the year, then call your stockbroker – make it a NY resolution!

Of course, the usual caveats about past performance not being indicative of future success apply…. Although, as I found out over the holidays, apparently it does apply to fishing ….

Cheers

Ben (and the team with special mention of thanks for Andrew for the graphs)

p.s.

Love my blog? Check out how we give you 25% of our revenue for sharing from the OnMarket App with your friends .

.png)