Highly prospective exploration projects in the heart of Nevada's lithium belt

OnMarket Bidding Closed Fulcrum Lithium Ltd ASX: FUL

Fulcrum Lithium Ltd IPO | ASX: FUL

This IPO is open to Australian and New Zealand investors.

The offer may close early and the 'Pay By' dates may change. Duplicate bids under the same investment profile, investor name or residential address may be cancelled.

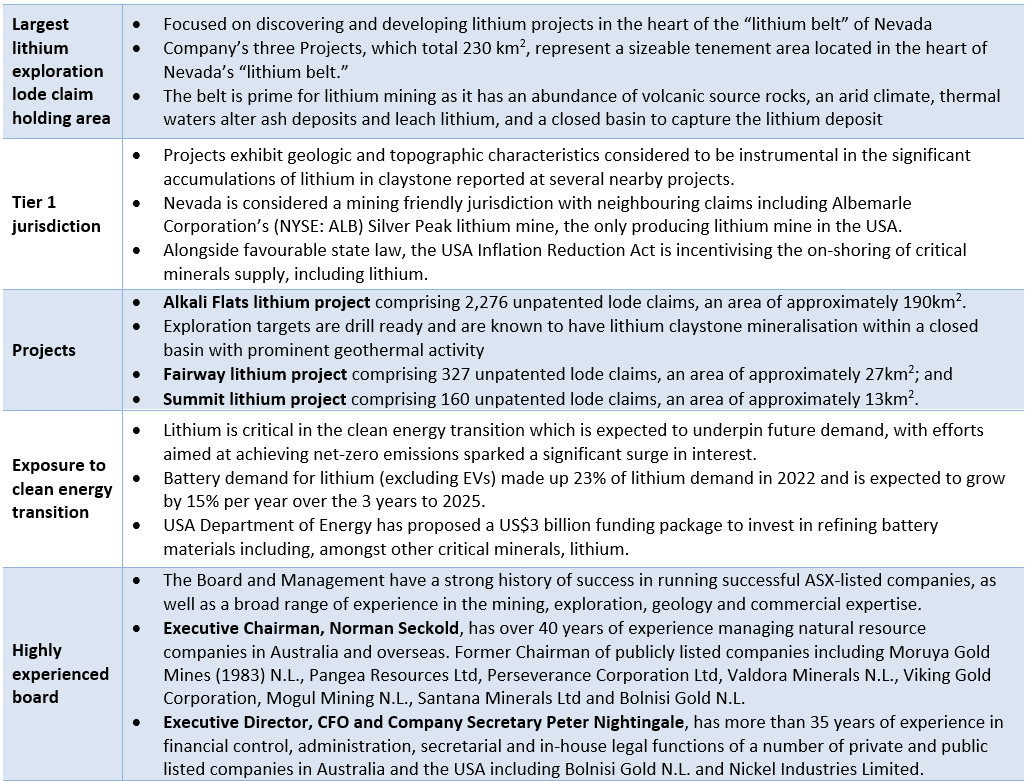

Key Investment Highlights

Introduction

Fulcrum Lithium Ltd (ASX: FUL) is focused on discovering and developing its lithium projects in the heart of the “lithium belt” of Nevada, USA with the company identifying and acquiring an interest in several lode claims prospective for lithium comprising the Alkali Flats, Fairway and Summit lithium Projects which represent one of the largest known portfolios of lode claims on the exploration for claystone hosted lithium deposits.

On 17 March 2023, the Company completed the acquisition of 100% of the issued capital of Fulcrum Nevada LLC (Fulcrum Nevada) and Last Basin LLC (Last Basin). Last Basin is the registered holder of the Alkali Flats and Summit projects’ lode claims.

Lode claims, which include classic veins or lodes having well defined boundaries, including broad zones of mineralised rock such as the Company’s targeted lithium mineralised rock, give the holder the right to access and conduct mineral exploration and mining under the guidelines and rules set forth in the General Mining Act.

The targeted mineralisation at the Projects is postulated to be geologically similar to other projects in the region, several of which have reported drilled resource estimates including the Tonopah Flats project owned by American Battery Technology Company (American Battery) (OTCQB: ABML), the TLC project owned by American Lithium Corp. (American Lithium) (TSX.V: LI), the Clayton Valley project owned by Century Lithium Corp. (Century Lithium) (TSX.V: LCE), the Bonnie Claire project owned by Nevada Lithium Resources Inc. (Nevada Lithium) (OTCQB: NVLHF), the Rhyolite Ridge project owned by Ioneer Ltd (Ioneer) (ASX: INR) and the Zeus project owned by Noram Lithium Corp. (Noram) (TSX.V: NRM).

Terms of the Offer

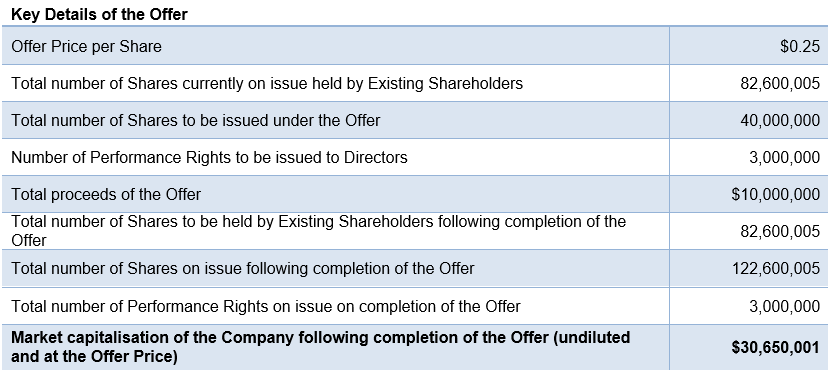

Fulcrum Lithium Ltd is looking to undertake an IPO on ASX to raise $10 million via the issue of 40 million shares under the Offer at an offer price of $0.25.

The IPO is being led by Lead Manager Bell Potter Securities Ltd.

Lithium Demand

Lithium is a critical component in the clean energy revolution that is currently underway and is expected to continue to play an important role in the evolution of the EV market. Efforts aimed at achieving net-zero emissions by the year 2050 have sparked a significant surge in interest surrounding battery technologies, particularly in the context of electric vehicles (EVs), clean energy solutions, and consumer products. While continuous developments in battery products and chemistries are underway, the lithium-ion battery remains a cornerstone technology driving the global transition toward cleaner energy sources.

The rapid increase in lithium consumption can be primarily attributed to the surging demand for electric vehicles and their reliance on rechargeable batteries. Notably, the demand for lithium in rechargeable batteries is experiencing substantially faster growth compared to other sectors requiring lithium for industrial purposes. Projections indicate that this heightened demand for lithium in batteries will persist, with global lithium consumption forecast to rise 16% per year to 2.3Mt in 2029.

Overall, battery demand for lithium (excluding EVs) made up 23% of lithium demand in 2022 and is expected to grow by 15% per year over the 3 years to 2025. Other sources of battery demand include utility-scale energy storage systems (ESS), portable electronics, and other small electric devices. The largest share of growth comes from ESS demand (5.9% of lithium demand in 2022), which is forecast to grow by ~18%.

Global lithium consumption by demand source (kt LCE)2

Company Overview

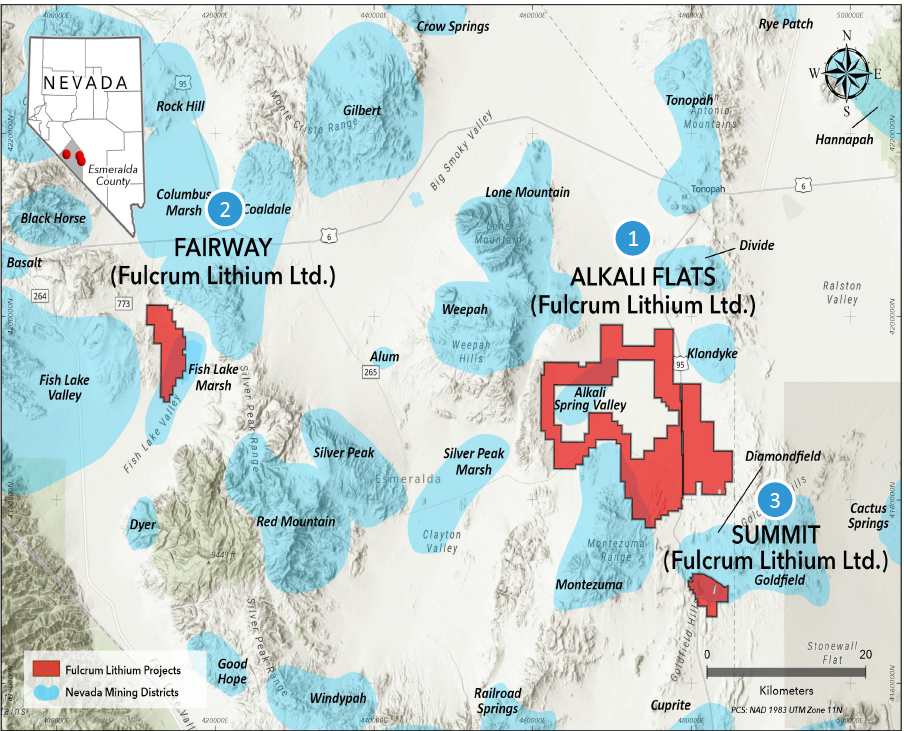

Fulcrum Lithium Ltd is a mineral exploration company focused on discovering and developing its lithium projects in the heart of Nevada, USA. The Company’s 100% owned lithium exploration Projects which cover a total of 230 km2 located in Esmeralda County, Nevada, USA, include:

- the Alkali Flats lithium project comprising 2,276 unpatented lode claims, an area of approximately 190 km2;

- the Fairway lithium project comprising 327 unpatented lode claims, an area of approximately 27 km2; and

- the Summit lithium project comprising 160 unpatented lode claims, an area of approximately 13 km2.

The Projects are located in the heart of Nevada’s “lithium belt” and based on limited exploration data, all three of the Company’s Projects are considered to be prospective for lithium mineralisation hosted in layered claystone units. Neighbouring projects include the Silver Peak mine owned by Albemarle Corporation (NYSE: ALB).

The Company plans to systematically explore all three Projects through geophysical tests, drilling and metallurgical test work with the aim of defining an economic mineral resource.

The Projects

Since incorporation, Fulcrum Lithium has identified and acquired an interest in several lode claims in Nevada, USA, prospective for lithium comprising the Alkali Flats, Fairway and Summit lithium projects (together the Company’s Projects). The Projects are proximate to, or on trend with, significant lithium projects at various stages of exploration and development in a geologic setting with the following characteristics:

- an abundance of volcanic source rocks;

- an arid climate;

- thermal waters alter ash deposits and leach lithium; and

- a closed basin to capture the lithium deposit.

Alkali Flats Project

The Alkali Flats project is the Company’s largest and initially primary project. The lode claims, which include rights to all locatable subsurface minerals, total approximately 190km2 on USA Federal land in the Clayton Valley within Nevada’s lithium claystone belt and is known as the Alkali Flats lithium project.

The Alkali Flats project is located in the heart of Nevada’s “lithium belt” approximately 15 kilometres south of Tonopah, a historic mining centre which is currently focused on servicing nearby lithium exploration and development activities, 10 kilometres northeast of Albemarle Corporation’s (NYSE: ALB) Silver Peak lithium mine, the only lithium producing mine in the USA and on trend with new claystone lithium projects at various stages of development.

The Exploration Target estimate for this primary area of the Alkali Flats Project is 3,420 million tonnes (“Mt”) to 7,350 Mt at a grade range estimated at 500 ppm Li to 700 ppm Li for an LCE estimate of 9.1 Mt to 27.4 Mt.

The Summit Project

The Summit Project consists of 160 lode mining claims, which include rights to all locatable subsurface minerals, total approximately 13 km2 on USA Federal land in the Lida Valley within Nevada’s lithium claystone belt and approximately 7.5 km from the southern boundary of the Alkali Flats Project.

Exploration of the Summit project has been limited to the collection of 8 rock chip and surface samples from areas where the Siebert Formation was projected to be exposed below the capping basalt formations and desktop reviews of the area in preparation for mapping of potentially favourable areas and a more comprehensive surface sampling program.

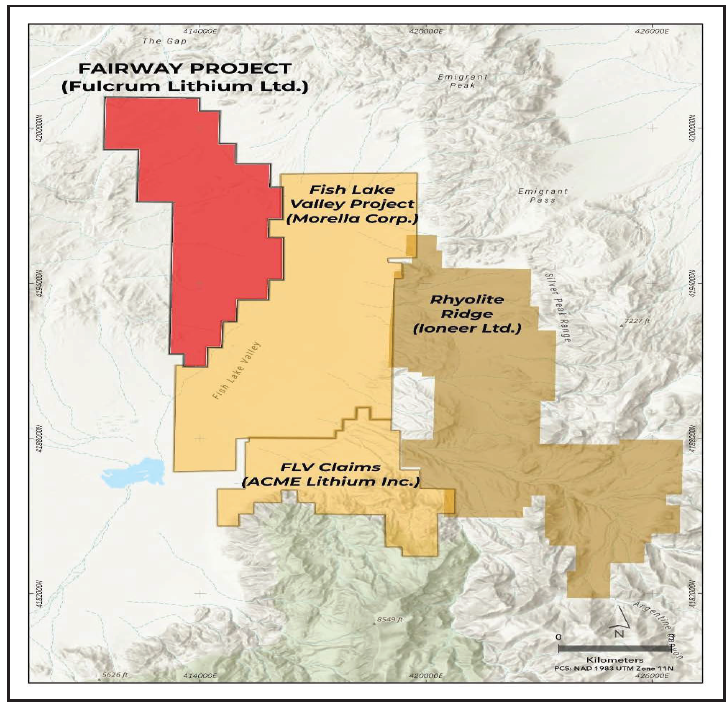

The Fairway Project

The Fairway Project is located along the western edge of the Fish Lake Valley in a large hydrogeological basin of the same name and a prominent hydrothermal basin. The Fairway Project consists of 327 lode claims, which include rights to all locatable subsurface minerals, total approximately 27 km2 on USA Federal land.

The Fish Lake Valley is currently an area of active lithium exploration, primarily claystone targets. There are three lithium projects currently being explored or developed adjacent to or near the Fairway project, all centred near the only producing lithium mine in the USA, Albemarle Corporation’s (NYSE: ALB) Silver Peak mine. The Fairway project is 40 kilometres northwest of the Silver Peak lithium brine operation, 8 kilometres northwest of Ioneer Ltd’s Rhyolite Ridge project, adjacent to Lithium Corporation/Morella Corporation Ltd’s Fish Lake Valley lithium project and approximately 8 kilometres northwest of ACME Lithium Inc’s FLV lithium claystone project.

Exploration by Fulcrum of the Fairway project has initially been focused on desktop evaluations of available data, published geological maps and examination of satellite image photos. This type of early evaluation is typical of preliminary investigation of lithium in claystone hosted deposits.

In addition, 8 rock chip and surface samples from the outer edges of sedimentary exposures, primarily from altered rhyolite and hot spring exposures and from claystone and interbedded claystone and siltstone outcrops have been collected. The lithium values from assays of the rock chip and surface samples ranged from a low of 35ppm Li to a high of 404 ppm Li.

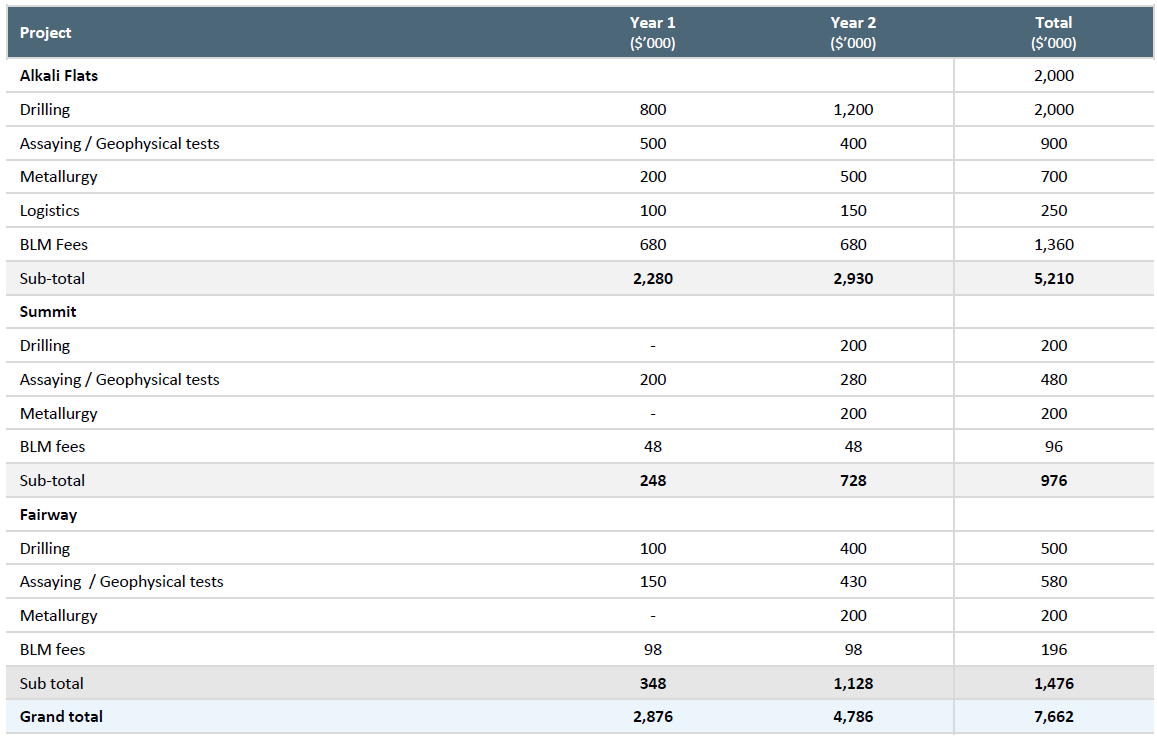

Proposed exploration budgets

The company plans to drill to test both the tonnage and grade potential of the Company’s Projects with the aim of being one of the next earliest lithium producers in the USA. Details of the budgeted expenditure at each of the Company’s Projects for the first two years of operation are as follows:

Management and Board

Fulcrum Lithium Ltd is led by a board with a broad range of experience in the mining industry, exploration and geology as well as commercial expertise. The Board is well positioned to implement the Company's strategic objectives. These include:

Norman A. Seckold– Executive Chairman

Mr Seckold has spent more than 40 years in the full time management of natural resource companies, both in Australia and overseas. Mr Seckold has been the Chairman of a number of publicly listed companies including Moruya Gold Mines (1983) N.L., Pangea Resources Limited, Timberline Minerals, Inc. Perseverance Corporation Limited, Valdora Minerals N.L., Viking Gold Corporation, Mogul Mining N.L., Santana Minerals Ltd and Bolnisi Gold N.L. Mr Seckold is currently Chairman of ASX Listed Alpha HPA Limited, Nickel Industries Limited and Sky Metals Limited.

Peter J. Nightingale – Executive Director, Chief Financial Officer and Company Secretary

Mr Nightingale has worked as a chartered accountant in both Australia and the USA. As a director or company secretary Mr Nightingale has, for more than 35 years, been responsible for the financial control, administration, secretarial and in-house legal functions of a number of private and public listed companies in Australia and the USA including Bolnisi Gold N.L. and Nickel Industries Limited. Mr Nightingale is currently a director of ASX listed Alpha HPA Limited and Prospech Limited.

Foster V. Wilson - Non-Executive, USA Representative Director

Mr Wilson has over 40 years of experience, with a focus on lithium claystone and brine exploration projects, in roles ranging from reserve drilling and estimation, feasibility studies, mine permitting and development. He has worked in various capacities for Placer Dome Inc., Echo Bay Mines Ltd., American Bonanza Gold Corp. and various junior exploration companies. Mr. Wilson served as President of TSX-V listed Mesa Uranium Corporation from 2005 to 2020. Mr. Wilson was a director of CSE listed Alpha Lithium Corporation from 2016 to 2023. Mr Wilson currently serves as a director of TSX-V listed Atomic Minerals Corporation and CSE listed Global Uranium Corporation.

Anthony Sgro - Non-Executive Director

Mr Sgro is a Chemical Engineer, graduating from University of Sydney. His studies included a thesis on Minerals Chlorination, which focused on the application of chlorination techniques to the extractive metallurgy of various minerals including titanium, nickel, chromium and tungsten ores. In a career spanning 45 years, Mr Sgro was involved in the technical and commercial aspects of supply of specialised equipment to the major process industries including oil and gas, petrochemical, chemical and mining industries, including equipment specification, material selection, commercial and technical aspects of large tenders, contract negotiation and contract management. Mr Sgro is currently a Non-Executive Director of ASX listed Alpha HPA Limited.

Key Offer Statistics

See ‘Summary of Offer’ section of the Prospectus for further information.

Use of Funds

Funds raised from the Offer will be applied as follows:

For further information on the Key Offer Statistics and Use of Funds, please see the prospectus.

Risks

You are encouraged to read the Prospectus carefully as it contains detailed information about the Company and the Offer. Like all investments, an investment in the Company carries risk. As set out in Section 7 of the prospectus, Fulcrum Lithium Ltd is subject to a range of risks, including but not limited to challenge to mining claims, third party unpatented mining claims, limited operational history, inherent industry risk, exploration and costs associated with exploration, future funding and going concern.

Section 734(6) disclosure: The issuer of the securities is Fulcrum Lithium Ltd ACN 665 528 307. The securities to be issued are ordinary shares. The disclosure document for the offer can be obtained by clicking on the link above. The offers of the securities are made in, or accompanied by, a copy of the disclosure document. Investors should consider the disclosure document in deciding whether to acquire the securities. Anyone who wants to acquire the securities will need to complete the application form that will be in or will accompany the disclosure document (which can be done via the electronic application form which will become available by clicking the bid button above).

The offer may close early and the 'Pay By' dates may change. Duplicate bids under the same investment profile, investor name or residential address may be cancelled.