Nasdaq IPO - Australian company providing next generation genetic testing for the global IVF industry

Offer Closed GenEmbryomics Ltd NASDAQ: XGEN

GenEmbryomics Limited (NASDAQ: XGEN)

GenEmbryomics Ltd is an Australian company that has lodged their F-1 Prospectus with the SEC to list their ordinary shares on the Nasdaq Stock Market under the symbol “XGEN”.

This is an expression of interest process only and is not a binding application.

OnMarket will provide further information to investors interested in participating in the IPO.

Please submit the A$ value of shares that you would like to apply for. The minimum application size is A$25,000 and the offer is only open Professional, Sophisticated and Experienced investors.

For information on the Nasdaq IPO application process - CLICK HERE

Investment Highlights

Introduction

GenEmbryomics Ltd (NASDAQ: XGEN) is an Australian genomics-based company providing IVF patients and providers insights into an embryo's genetic disease via their flagship test Panacea GenomeScreen™ which offers preimplantation genetic testing (PGT) via whole genome sequencing (WGS) of individuals, couples and IVF embryos. The test, which is intended to launch commercially in the third quarter of the fiscal year ended June 30, 2025, will provide IVF clinics with an actionable genome report screen for over 3,200 severe and fatal genetic diseases, enabling deeper understanding and greater confidence by clinicians and patients undertaking fertility treatments.

The test will utilise GenEmbryomics’ proprietary genome analysis algorithms, and are embedded within the platform to prioritise and generate reports. Prospective parents will be able to access the information provided through PGT-WGS reports provided through their proprietary artificial intelligence platform.

This advanced technology sets the Company apart from competitors who only test to detect aneuploidies (gain or loss of chromosomes) through less comprehensive methods. GenEmbryomics’ proprietary AI-powered platform and bioinformatics pipeline will be central to delivering these insights they anticipate that they will drive revenue through partnerships with IVF clinics worldwide.

Their primary business objectives are to establish GenEmbryomics as the go-to partner for genomic testing solutions in the IVF industry, driving innovation in reproductive healthcare, and ultimately helping more families achieve their dreams of having healthy babies.

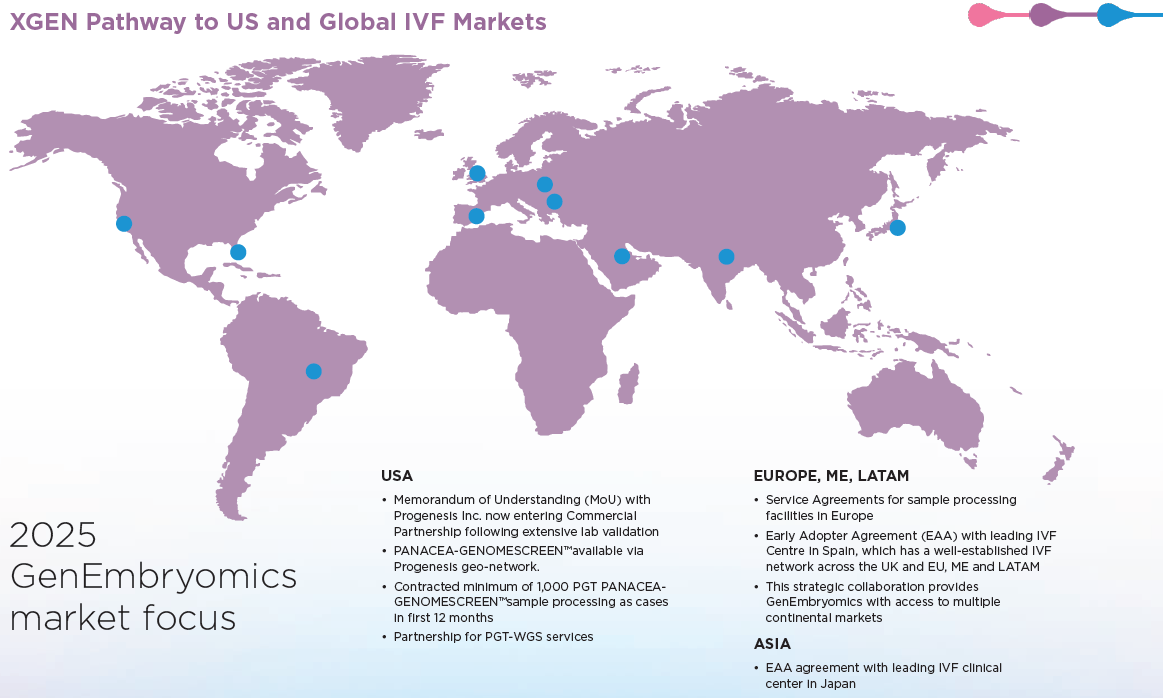

With a potential strategic partnership with Progenesis, a leading provider of PGT services, GenEmbryomics are poised to introduce the PGT-WGS platform in key markets across the United States and beyond.

Offer Overview

GenEmbryomics Ltd is looking to undertake an IPO on Nasdaq to raise ~US$5.2 million via the issue of 1,095 million shares at an anticipated offer price of US$4.75.

Industry Overview

In the evolving landscape of healthcare, human DNA analysis is increasingly recognised as a cornerstone of modern medical practice. This foundational knowledge has the potential to usher in transformative improvements in health outcomes and to enable substantial cost savings in healthcare through personalised preventive measures.

The power of genetic testing lies in its capacity to detect the risk of certain disease development early, accurately, and cost-effectively. The findings can profoundly affect the lives of millions, paving the way for early interventions that could save billions in healthcare spending. The advent of next-generation sequencing (NGS), an advanced DNA sequencing technology that can rapidly analyse millions of DNA fragments in parallel, has been instrumental, revealing invaluable insights into the genomics of diseases and fostering the emergence of a new category of diagnostic tests that are fine-tuning patient care. The cost of sequencing a human genome has been declining over the past two decades.

The IVF market is anticipated to exhibit significant market growth across the next decade, owing to escalating infertility rates (currently 1 in 5 couples seek assisted fertility/IVF); increasing parental age of first-child worldwide resulting in more genetic abnormalities; single parent families and the LGBTQ+ community wishing to grow a family; rise in global disposable income; and a surge in IVF utilisation and success rates.

The IVF and Whole Genome Sequencing markets are anticipated to exhibit significant growth

Company Overview

GenEmbryomics was founded in January 2019 by Dr. Nicholas Murphy, but the ground work for the Company’s technology began a decade earlier. In 2016, Dr. Murphy published his seminal paper on the use of single chromosomes for perfect matching of immune systems for bone marrow transplant cases. This expertise in single chromosomes analysis led Dr. Murphy to pivot into the preimplantation genetic testing industry to detect de novo (new) mutations that were already known to exist in a family through genetic screening. During his time in the PGT industry, Dr. Murphy observed issues and limitations in the field of preimplantation genetics testing that he believed would be addressed by applying clinical genome sequencing.

In 2022, Prof. Santiago Munne joined the Company and with his expertise in the PGT industry, the Company concentrated on refining the PGT-WGS test Panacea-GenomeScreen™ for clinical rollout through validation studies and partnerships with labs for acquiring validation samples and potential clients. In 2023, the Company entered into a Memorandum of Understanding (MoU) with Progenesis to introduce GenEmbryomics’ PGT-WGS platform in key markets across the United States and beyond. This potential strategic partnership with Progenesis will be crucial in advancing the Company’s technology and positioning them for success upon entry into the PGT market.

Growth Plan

GenEmbryomics is strategically positioned to launch its business and achieve significant revenue growth by harnessing the synergies of market penetration, innovation, reliability, and affordability. Through the utilisation of GenEmbryomics’ comprehensive genome analysis technology and a team of highly skilled professionals, they are on the cusp of delivering premier genomic testing services that are integral to the selection of genetically suitable embryos. GenEmbryomics is positioning to be a leader in IVF genetic testing in the following manner:

- Ongoing focus on establishing and maintaining key relationships with genetic testing, manufacturing and software companies, to allow them to facilitate the delivery of GenEmbryomics’ products and services in a commercially viable manner;

- Promoting GenEmbryomics’ products as superior to other methods of genomic sequencing and screening via direct sales via an Early Adopter Agreement with IVF clinics and physicians;

- Sales and promotion with the PGT service company Progenesis Inc. with discounted outsourcing

- Custom-developed applications for both physicians and patients to track samples and receive results;

- Developing GenEmbryomics’ research and development partnerships;

- Adopting and maintaining quality management systems to ensure the accuracy and reliability of GenEmbryomics’ testing service; and

- Expanding their intellectual property portfolio by maintaining their 100%-owned U.S. patent application for Panacea-GenomeScreen™, and working to have GenEmbryomics’ additional pending patent applications inside and outside of the United States proceed towards allowance, and filing additional patent applications to protect GenEmbryomics’ new discoveries.

Strategy Steps

The Company’s strategy is based on a profound understanding of the IVF market and delivering PGT-WGS testing that can benefit the healthcare industry and IVF clients. To achieve this objective, we intend to pursue the following:

- Establish collaborative effort with Progenesis. By progressing GenEmbryomics’ MoU into a non-binding Heads of Agreement and/or binding commercial agreement and collaborating with Progenesis to establish a PGT laboratory with a network of IVF clinics, they aim to introduce GenEmbryomics’ PGT-WGS test and technology to the United States IVF clinics and patients.

- Maximise commercial potential by establishing relationships with pre-existing IVF clinics, particularly through GenEmbryomics’ potential strategic partnership with Progenesis. This collaboration will allow them to leverage Progenesis’ extensive network of fertility clinics, industry expertise, and market access to accelerate the adoption of GenEmbryomics’ PGT-WGS test and expand global reach.

- Seek government approvals and regulatory clearances to support the widespread adoption of GenEmbryomics’ PGT-WGS test and other genomic solutions. By working closely with regulatory agencies and industry stakeholders, they aim to establish the necessary frameworks and guidelines to ensure the safe, effective, and ethical use of their technology in reproductive healthcare settings.

- Expand GenEmbryomics’ clinic base through direct sales and marketing efforts. By providing comprehensive support, training, and educational resources to fertility clinics, they aim to establish the Company as the go-to partner for genomic testing solutions in the IVF industry, driving sustained growth and market leadership.

- Obtain further intellectual property protections to safeguard GenEmbryomics’ proprietary technology and maintain competitive advantage. This includes actively filing new patents covering GenEmbryomics’ genome analysis algorithms, testing processes, and product designs, as well as securing trademarks and other intellectual property rights in key markets worldwide, including Australia, China, Europe and the United States.

- Expand GenEmbryomics’ genome testing and analysis products and research pipeline. This includes developing new applications for PGT-WGS, such as expanded carrier screening, non-invasive prenatal testing, and genetic risk assessment for pregnancy complications, as well as exploring innovative technologies like long-read sequencing and AI-powered data analysis to enhance the precision and predictive power of GenEmbryomics’ tests.

Panacea-GenomeScreen™

The flagship product, the Panacea-GenomeScreen™ PGT-WGS test, provides in a single test the screening of embryos for over 3,200 genetic early-in-life onset, life-threatening and fatal genetic disorders, chromosomal abnormalities, and other genetic factors that can impact implantation success, pregnancy viability and embryo long-term health. Panacea-GenomeScreen™ uses whole genome sequencing and AI-driven data analysis, setting a new standard of care in PGT and expanding access to cutting-edge genomics technologies.

Panacea-GenomeScreen™ has been designed to detect the complete array of genetic mutations, providing a thorough screening that encompasses the full spectrum of known mutational types that can affect human health. By capturing a catalogue of genetic alterations, Panacea-GenomeScreen™ offers the most comprehensive screening tool that can unveil hereditary conditions, and crucially, any de novo (new) mutations introduced at fertilisation. This exhaustive scope of detection positions Panacea-GenomeScreen™ to be a leading force in the field of genomic medicine, providing critical information for informed reproductive decisions and future health management.

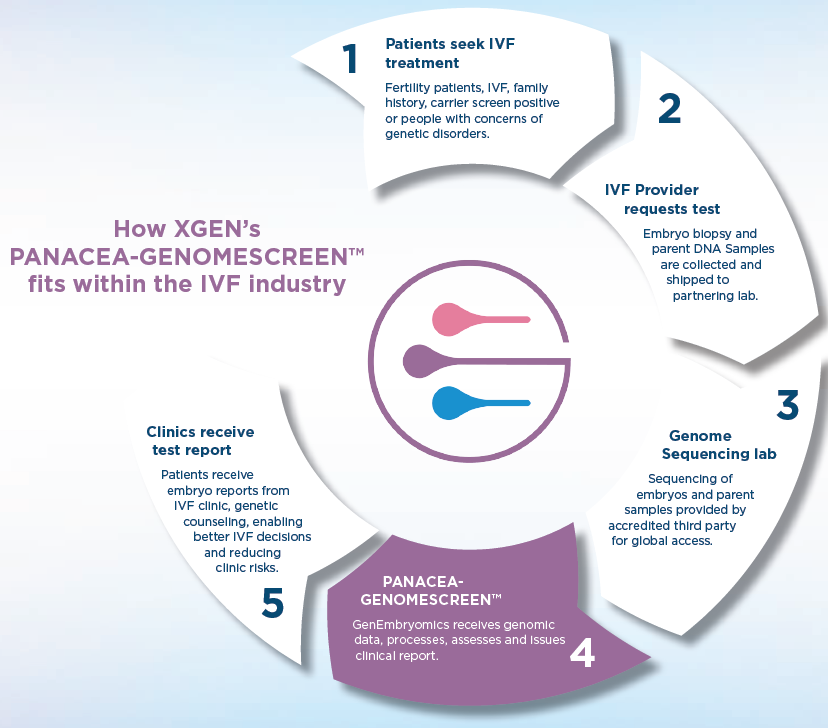

How it works

The process begins with the collection of saliva from the parents, which is used to sequence their genomes to aid in the embryo genome sequencing. The embryos are created via standard in vitro fertilisation, a biopsy is performed, and a small number of cells are carefully extracted for analysis without compromising the embryo’s development.

A benefit of Panacea-GenomeScreen™ is that IVF embryos are also suitable for testing, avoiding the current limits of PGT which requires the embryos to be tested following intracytoplasmic sperm injection (a fertility procedure where a single sperm is directly injected into an egg cell). The DNA from both the parents and the embryo is then sequenced and analysed. Bioinformatics and variant prediction software are utilised to sort and prioritise variants using AI algorithms, identifying both inherited and de novo mutations.

The genetic information of the embryo is cross-referenced with the genomic data of the parents to provide a comprehensive trio analysis that enhances the accuracy of the test. Panacea-GenomeScreen™ screens for over 2,500 genes known to be associated with the most severe diseases that are ethically acceptable for screening, based on a foundation of justified screening literature and evidence of track-record. This comprehensive screening includes a personalised analysis that accounts for ethnic and geographic diversity, detects fertility fraud (unauthorised substitution or misuse of reproductive materials), and consanguinity (genetic relatedness between prospective parents). Upon completion of the analysis by the Company, the embryo genome report is sent to the IVF clinic where the clinician conveys the findings to the patients and the embryology lab team facilitates the appropriate embryo transfer.

Genome Sharing Platform

As part of their research and development efforts, GenEmbryomics are in the process of developing a groundbreaking genome sharing platform that will enable the secure and efficient sharing of genomic data among researchers, clinicians, and patients.

This platform is intended to play a crucial role in accelerating the discovery and validation of new polygenic risk scores and advancing the field of personalised medicine. Polygenic risk scores are calculations combining the effects of multiple, typically low risk genetic variants to estimate disease risk. The genome sharing platform will be interrelated with the outputs of the Company’s key product Panacea-GenomeScreen™ and the other genome sequencing products in its development pipeline. By integrating data from various products, the platform will enable the construction of better, haploid genome data through trio analysis and haplotype phasing (a process that determines which genetic variants are inherited together on the same chromosome from each parent). Additionally, the Company plans to leverage the UK Biobank, a comprehensive population-based dataset, as a valuable resource for discovery and validation studies.

Key Board and Management

GenEmbryomics Ltd are led by a highly experienced board and management team with extensive experience in genomics applied to IVF, commercialising deep technologies, reproductive health and biotech pharma and management of listed companies. This includes:

Nicholas M. Murphy B.Sc (Hons), Ph.D – CEO and Managing Director

Dr. Nicholas Murphy founded the Company in 2019 and has served as Chief Executive Officer and Managing Director of the Board since the Company's inception. Since 2017, Dr. Murphy has served as an Adjunct Research Fellow at Monash University. From 2018-2023, Dr. Murphy was a Senior Development Scientist at Genetic Technologies Limited (ASX:GTG / Nasdaq:GENE), a molecular diagnostics company focused on genetic testing and risk assessment. Dr. Murphy has also previously serviced in scientific positions at Monash IVF, Melbourne IVF, and as a Postdoctoral Researcher at Monash University. Dr. Murphy is a member of the Audit and Risk Committee and is a proposed member of our intended Business Development and Operations Committee. Dr. Murphy brings extensive expertise in genomics applied to IVF and reproductive health, combined with over a decade of direct industry experience, to the Company, and his qualifications in genomics, the IVF industry, and founding role at the Company make him exceptionally suited to serve on the Board.

Paul K. M. Viney – Chairman and Independent Director

Mr. Paul Viney joined the Board in and has served as our Chairman since January 2023. Mr. Viney is currently Managing Director of Braddon Capital, a global venture capital firm that works on deep technology commercialisation and corporatisation, as well as mergers and acquisitions. From 2018 to 2019, Mr. Viney served as Chief Financial Officer, Chief Operating Officer and Company Secretary of Genetic Technologies Limited. Mr. Viney previously served as Executive Director of Powerhouse Ventures Limited (ASX:PVL), which he guided to an ASX IPO in 2017, and as CFO and Company Secretary of Tasmanian Perpetual Trustees Limited (ASX:TPX). From 2003-2013, Mr. Viney served as Chief Financial officer and Company Secretary of MyState Limited (ASX:MYS), a retail banking and wealth management group. Mr. Viney currently serves as a Director of deep tech companies Functional Coatings Limited (NZ), Aerotec Power Pty Ltd. and is Chairman of Hydrowood Holdings Pty Ltd. Mr. Viney is also Chairman of General Practice Tasmania Inc. Mr. Viney is a member of the Audit and Risk Committee and the Chair of the Remuneration and Nominations Committee. Mr Viney's diverse executive and board experience provides valuable strategic guidance as the Company aims to scale its operations and expand access to its genetic testing services.

Kathryn Andrews – Chief Financial Officer

Ms. Kathryn Andrews joined the Company as Chief Financial Officer on December 19,2024. Ms. Andrews has over two decades of experience in financial management and corporate governance work. From March 2024 to July 2024, Ms. Andrews served as Chief Financial Officer and Company Secretary at Genetic Technologies Limited, a diagnostics company specialising in genomics-based tests. She also held the position of Chief Financial Officer at Alterity Therapeutics Limited (formerly Prana Biotechnology Limited) from 2014 to 2024, where she oversaw all financial operations, including budgeting, forecasting, financial reporting, taxation, corporate governance, compliance, and risk management. Ms. Andrews also has experience leading outsourced finance teams and managing relationships with auditors, tax authorities, and other professional advisors. She holds a Bachelor of Commerce (BCom) from the University of Melbourne and is a member of the Australian Institute of Company Directors (MAICD), a Fellow of the Governance Institute of Australia (FGIA), and a Certified Practicing Accountant (CPA). Ms. Andrews' extensive experience, particularly with ASX and Nasdaq listed companies makes her well suited to guide the Company’s financial strategy and operations as Chief Financial Officer

Santiago Munné Blanco – Non-Independent Director

Dr. Santiago Munné Blanco joined the Board in January 2024. Dr. Munné currently serves as Chief Innovation Officer at Overture Life, a company revolutionising fertility treatment through automation, and is the Scientific Director at Progenesis, a leading preimplantation genetic testing (PGT) laboratory which is partnering with the Company. Dr. Munné has founded and co-founded multiple successful genomics companies, including Reprogenetics, Recombine, Phosphorus, MedAnswers, and G1 Sciences. He also co-founded Homu Health Ventures, an accelerator focused on nurturing and supporting startups in the reproductive health sector. Dr. Munné holds a Ph.D. in Human Genetics from the University of Pittsburgh, further complemented by a Bachelor's degree in Biology from the Universitat Autònoma de Barcelona. Dr. Munné is a proposed member of our intended Business Development and Operations Committee. Dr. Munné’s deep understanding of reproductive genetics and unwavering commitment to advancing the field make him an invaluable asset to the Board.

Nicholas J. Burrows (B.COM, FAICD, FCA, FGIA, FTIA, F FIN) – Independent Director

Mr. Burrows joined the Board in November 2023. Mr. Burrows previously served as Chief Financial Officer and Company Secretary of Tassal Group Limited (an ASX listed entity) for 21 years from 1988 to 2009. Mr. Burrows also served as National President of the Governance Institute of Australia in 2002 and served on their National Board for 6 years. Mr. Burrows is currently an independent non-executive director of Seafood Industry Australia (appointed in 2023), the national peak-body representing the Australian seafood industry; an independent non-executive director of Plastic Fabrications Pty Ltd (appointed in 2023), an advanced manufacturing company; and Chair of the Shareholder Council of a large family office operating in the tourism and hospitality sector (appointed in 2014). Mr. Burrows also chairs a number of audit and risk committees across the government and private sector. Mr. Burrows has previously served as an independent non-executive director and audit and risk committee chair of Genetic Technologies Limited from 2019 to 2024, a dual ASX and Nasdaq listed company specialising in diversified genomics and AI driven preventative health diagnostics; as an independent non-executive director and audit and risk committee chair of Clean Seas Seafood Limited from 2012 to 2021, an ASX listed entity specialising in full cycle breeding, production and sale of Yellowtail Kingfish; as an independent non-executive director and audit and risk committee chair of Tasmanian Water and Sewerage Corporation Pty Ltd.

Saadia Basharat B.Sc (Hons), M.Sc, Ph.D – Independent Director

Dr. Saadia Basharat jointed the Board in March 2024. Dr. Basharat currently serves as the Principal & Head of West Coast Consulting at Alacrita Consulting, where she has worked since 2014. Dr. Basharat holds a BSc (Hons) in Biomedical Informatics, a MSc in Molecular Medicine and a Ph.D. in Neuroendocrinology from Imperial College London. Dr. Basharat is a member of the Remuneration and Nominations Committee and is the proposed Chair of our intended Business Development and Operations Committee. Dr. Basharat's extensive background in the life science industry and her academic knowledge related to biotech and pharma companies qualifies her to serve on our Board

Teresa R. Burleson – Independent Director

Ms. Teresa Burleson joined the board in March 2024. Ms. Burleson holds the position of Chief Operating Officer at The Translational Genomics Research Institute (TGen) and is the President of TGen Health Ventures. Ms. Burleson has over two decades of experience in the life sciences industry, and has served in a variety of executive level roles, including CFO, COO, and President. Ms. Burleson is currently an independent non-executive director of the Nasdaq listed biopharmaceutical company, Salarius Pharmaceuticals, Inc., where she is a member of the Audit Committee and serves as Chair for the Governance and Nominating Committee. Ms. Burleson is a CPA, has an MBA from the UNM Anderson School of Management, as well as an Advance Finance certification from The Wharton School at University of Pennsylvania. Ms. Burleson has served as a partner in venture groups focused on early-stage biotechnology and health-focused services and has public board expertise as well as private company board experience, spanning both profit-driven and philanthropic endeavours, making her an invaluable member of our Board. Ms. Burleson is a member of the Audit and Risk Committee.

Key Offer Statistics

GenEmbryomics Limited is offering 1,095,000 ordinary shares in their Nasdaq IPO. It is anticipated that the offering price will be US$4.75 per share raising approximately US$5.2 million.

Use of Funds

GenEmbryomics estimate that they will receive approximately US$3,868,237 of net proceeds in this offering based on an initial public offering price of US$4.75 per share from the sale of 1,095,000 Ordinary Shares, after deducting the underwriting discounts and commissions and estimated offering expenses of approximately US$1,333,013 payable by them and assuming no exercise of the underwriter’s over-allotment option. If the underwriter’s over-allotment option is exercised in full, the net proceeds will be approximately US$4,648,424.

GenEmbryomics Ltd intend to use the net proceeds received from this offering as follows:

- Repayment of the principal and accrued interest outstanding of approximately US$783,288 on the Promissory Notes on the date of closing of this offering;

- Repayment of the principal and accrued interest outstanding of approximately US$595,116 on unsecured loans on the maturity dates;

- Approximately US$500,000 to support and grow our United States operations, including the expansion of our database curator scientist staff for scaling up operations, implementation of new software (including an enterprise scale LIMS (Laboratory Information Management System) for tracking samples and managing laboratory workflows, and EHR (Electronic Healthcare Record)), and employment of additional managers;

- Approximately US$200,000 to support potential Progenesis growth and expansion opportunity, including additional validation and verification of analysis pipelines for clinic onboarding, a novel use case scenario workups/feasibility study, co-marketing with Progenesis for Panacea-GenomeScreen™ PGT-WGS and Couplet-GenomeScreen™, and integration costs with the Progenesis EHR (Electronic Healthcare Record);

- Approximately US$150,000 for the continued development of Ova-GenomeScreen™, which we estimate will fund development through to clinical validation;

- Approximately US$200,000 for the continued development of Serendipity-GenomeScreen™, which we estimate will fund development through to analytical validation;

- Approximately US$300,000 for the development of our Genome Sharing Platform, which we estimate will fund development through to rollout; and

Approximately US$1,141,351 is to be used as general working capital and for general corporate purposes.

Risks

You are encouraged to read the Form F-1 Registration Statement / Prospectus carefully as it contains detailed information about the Company and the Offer. Like all investments, an investment in GenEmbryomics Ltd carries risk. As set out in the Risk Section of the prospectus, GenEmbryomics Ltd is subject to a range of risks, including but not limited to early stage company risk, additional financing, market and development of the product, market acceptance, competitive market, ethical, social and legal concerns.

The issuer of the securities is GenEmbryomics Limited. The securities to be issued are ordinary shares. The disclosure document for the offer can be obtained by clicking on the link above. The offers of the securities are made in, or accompanied by, a copy of the disclosure document. Investors should consider the disclosure document in deciding whether to acquire the securities. Anyone who wants to acquire the securities will need to complete the application form that will be in or will accompany the disclosure document (which can be done via the electronic application form which will become available by clicking the bid button above).

- This is an expression of interest process only and is not a binding application.

- Please submit the A$ value of shares that you would like to apply for.

- GenEmbryomics Ltd is an Australian company that has lodged their F-1 Prospectus with the SEC to list their ordinary shares on the Nasdaq Stock Market under the symbol “XGEN”.

- The offer is only open to Professional, Sophisticated and Experienced investors.

- Investors that submit their expressions of interest will be provided the opportunity to apply for shares under the IPO via our partner FINRA registered broker dealer, Kingswood Capital Partners, located in the United States.

- As part of the application process you will be required to disclose certain information including your name, address and provide copies of your identification.

- To complete an application for shares under the IPO, investors will be required to transfer funds to Kingswood Capital Partners.

- OnMarket will reach out to investors to provide next steps to complete the application process.

- For more information please contact support@onmarket.com.au