Disrupting the Global Pilates Market with Tech-Enabled Classes from Just $5

Offer Closed Pronto Pilates Pty Ltd

Pronto Pilates Pty Ltd | Equity Crowdfunding Offer

Offer closed

$1,625,435

Raised482

InvestorsPlease consider the offer document and general risk warning before investing.

Retail investors are entitled to a 5 day cooling-off period.

Investments over $10,000 are restricted to Sophisticated investors - Apply here

Click here to learn more about Equity Crowdfunding

Extraordinary Global Tech Disruption Opportunity

Pilates, a century-old exercise discipline practised by 20 million students worldwide is ripe for disruption. Despite its popularity, high costs and limited class schedules have kept this life-changing exercise discipline out of reach for many.

In late 2022, we identified an opportunity to democratise access to Pilates and to disrupt this multi-billion dollar global industry. Our theory…

For 75% less, Pilates students will trade-off live instruction for on-screen instruction.

Leveraging our technology and marketing expertise, we launched a pilot studio to test our theory. We offered group reformer Pilates classes from just $5 instead of the traditional $20 to $30.

Results were extraordinary. Within months, the studio had hundreds of members returning $45k in Monthly Recurring Revenue (MRR) with a 73% profit margin.

We realised we were onto something big—a way to tech-disrupt a global industry and make Pilates both affordable and accessible to everyone!

Missed the Pronto Pilates Investor Q&A? Click here to watch.

Disrupting a $174B Global Market

Here's 8 reasons why Pronto Pilates is a great investment:

- Massive Price Disruption: Pronto offers all-day reformer Pilates classes from just $5—an unprecedented 75% savings compared to traditional studios, with no compromise in class quality.

- 170 inquiries to own a Pronto studio in the first 3 weeks of October equating to an extraordinary $132M sales pipeline (based on an $800K LTV per sale). Extreme demand to greatly de-risk Pronto’s 1000 studio growth projection.

- Product–Market Fit: In just 20 months, Pronto has expanded to 14 studios nationwide serving 6,000 members who have taken 160,000 classes, validating our tech-enabled model.

- Scalable Technology Platform: Our proprietary “Studio as a Service” (SaaS) tech platform enables rapid expansion and high profitability by reducing staffing costs and operational friction.

- Stunning Unit Economics: Studios average $35k in Monthly Recurring Revenue (MRR) and a 55% profit margin within 6 months, significantly outperforming traditional studio models.

- High Studio Ownership ROI: Investors can own a Pronto studio. An exceptional "passive investment" with proven ROI of 67% to 112%--double industry benchmarks for fitness studios.

- Global Market Opportunity: Positioned for growth to 1000 studios by 2028 (3% market share) across APAC, North America and UK/Europe. This represents a realistic 3% market share.

- Clear Exit Strategy: Multiple paths for high investor returns, including acquisition by major fitness or tech firms, IPO or sustained dividend payouts.

Exciting 2028 Growth Strategy

Pronto currently operates 14 studios nationwide with 11 more in development for 2024. Ending the year with 25 studios and with plans to launch in the US in early 2025.

Our 1000 studio goal will be achieved with a blend of 100 company-owned and 900 investor-owned studios.

I love Pilates and signed up to own two Pronto studios. It’s the perfect passive investment that works around my career as a financial controller. ~ Mel T.

Our strategy accelerates growth by sharing the rewards of our high-profit model. We're positioning Pronto as a 'Studio as a Service' (SaaS) tech platform, minimising physical asset ownership to maximise scalability and returns.

The graph illustrates our projected ARR growth, reaching over $200 million by 2028. And attracting a premium enterprise valuation based on the majority SaaS revenue.

Pronto’s ambitious growth projections are supported by our parent company (Vortala) with 20-year established worldwide operations serving 2500 healthcare clients across 20 countries.

Perfect Market Timing

In business, timing is everything!

Pronto is perfectly timed with the confluence of three powerful trends: the Pilates market growing at 11.26% CAGR, the fitness technology market surging at 18.10% CAGR, and rising cost-of-living concerns highlighting demand for affordable fitness solutions.

With the global Pilates & Yoga market projected to reach USD $409 billion annually by 2032, Pronto's affordable, tech-enabled model is perfectly positioned to capture a significant share.

Our goal of 1,000 studios by 2028 represents just 3% of this vast opportunity, underscoring our strategy's realistic ambition.

As we expand globally, Pronto's unique "Studio as a Service" (SaaS) model enables rapid scaling by minimising capital requirements and operational complexities.

Pronto's innovative approach and first-mover advantage allows us to rapidly deploy new studios while delivering exceptional value and returns to all stakeholders - studio members, studio owners, and Pronto shareholders alike

Creating a New Market Category

Pronto Pilates is breaking ground with a new category:

Tech-Enabled, All-Day, Affordable Reformer Pilates

Our unique approach doesn’t just make Pilates more accessible—it opens a “Blue Ocean” of untapped demand by attracting non-traditional Pilates customers.

In fact, 30% of Pronto members are completely new to Pilates, proving that we’re expanding the market, not just competing within it.

This is my first time doing Pilates, And Pronto’s orientation class made it so easy to get started. I’m now up to 10 classes and loving it! ~ Maggie D.

This “Blue Ocean” strategy has been the cornerstone for some of the most successful disruptors across industries—and Pronto is next in line.

Investor Rewards

As a way of saying 'thank you' for joining us on the Pronto journey, we're excited to offer investors the following rewards based on their contribution level:

These rewards not only express our gratitude but also offer unique opportunities to be more involved in the Pronto community, with benefits designed to enhance both personal well-being and investment value.

The Leadership Team

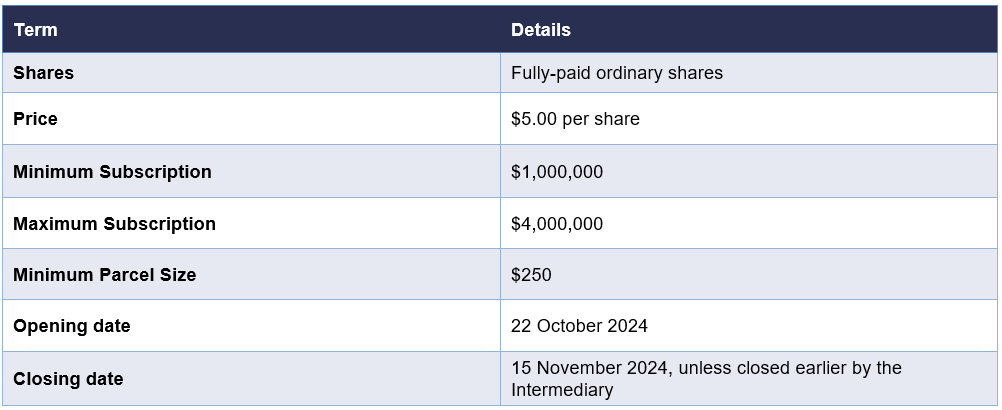

Terms of the Offer

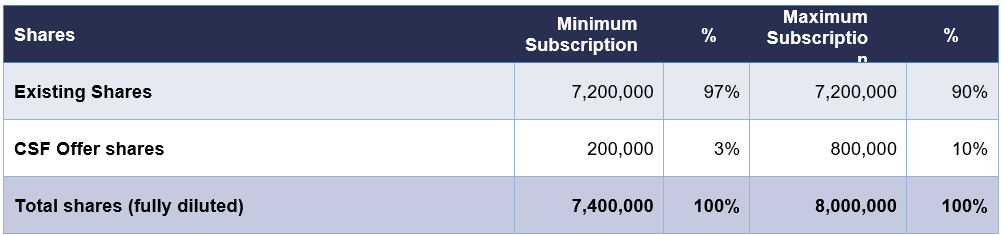

Issued Capital

For more detailed information, please read the Capital Structure section of the offer document.

Use of Funds

For detailed information on the use of funds, please see section 3 of the Offer Document

Company Risks

Pronto Pilates Pty Ltd's is disrupting the Pilates industry with all-day, $5 classes and their "Studio as a Service" (SaaS) tech platform is a game-changer. As with any growth business, an investment in the Company should be seen as high-risk and speculative. A description of the main risks that may impact their business are listed in the offer document. Investors should read this section carefully before deciding to apply for shares under the Offer. There are also other, more general, risks associated with the Company (for example, execution, market competition, economic downturn, regulatory changes, technology dependencies, studio owner management or the inability to sell their shares). See the Risk section in the Offer Document for further information.

The Offer is subject to a Maximum Subscription amount of $4,000,000. If the Maximum Subscription is reached, the Offer will close early. Applications will be treated on a time priority basis and may be subject to scale back, so please fund your application as soon as possible.

RISK WARNING: Crowd-sourced funding is risky. Issuers using this facility include new or rapidly growing ventures. Investment in these types of ventures is speculative and carries high risks. You may lose your entire investment, and you should be in a position to bear this risk without undue hardship. Even if the company is successful, the value of your investment and any return on the investment could be reduced if the company issues more shares. Your investment is unlikely to be liquid. This means you are unlikely to be able to sell your shares quickly or at all if you need the money or decide that this investment is not right for you.

Even though you have remedies for misleading statements in the replacement offer document or misconduct by the company, you may have difficulty recovering your money. There are rules for handling your money. However, if your money is handled inappropriately or the person operating this platform becomes insolvent, you may have difficulty recovering your money. Ask questions, read all information given carefully, and seek independent financial advice before committing yourself to any investment.

5 DAY COOLING OFF PERIOD: There is a 5 business day cooling off period for retail investors. During this period, you may withdraw your application and receive a full refund into your nominated refund account. Please note: After the 5 day cooling off period has expired, you will be unable to withdraw your application. More information here.

ONMARKET FEES: Upon successful completion of the Offer, a maximum fee of 6.0% of the funds raised will be paid to OnMarket by the Company.

ONMARKET INTERESTS: OnMarket and its associates may be participating in this offer.

ONMARKET INTERESTS AND AMOUNTS SUBJECT TO COOLING OFF: The funding bar displayed under each crowd funding offer may include applications where payments are yet to be made and amounts that are subject to the cooling off period.

Section 734(6) disclosure: The issuer of the securities is Pronto Pilates Pty Ltd ACN 668 908 012. The securities to be issued are fully-paid ordinary shares. The disclosure document for the offer can be obtained by clicking on the link above. The offers of the securities are made in, or accompanied by, a copy of the disclosure document. Investors should consider the disclosure document in deciding whether to acquire the securities. Anyone who wants to acquire the securities will need to complete the application form that will be in or will accompany the disclosure document (which can be done via the electronic application form which will become available by clicking the bid button above)

Company Releases

Offer Document 22 Oct 2024Pronto Pilates GPFS 2024 22 Oct 2024Company Constitution 18 Oct 2024Investor Webinar Presentation 18 Oct 2024Pronto Pilates GPFS 2024 - Signed 28 Oct 2024Media

Video | Investor Q&A 18 Oct 2024Perthnow | Pronto Pilates Scarborough: New $5 class pilates studio to open in October 2024 22 Oct 2024News.com.au -- Viral workout now cheaper than ever before at $5 a class 19 Oct 2024UrbanList -- 15 Of Perth's Best Pilates Studios To Try In 2024 02 Jan 2024Women's Health -- The Best Reformer Pilates Classes in Australia 05 Mar 2024Yahoo Lifestyle -- Introducing the reformer pilates classes that only cost $5 13 Oct 2024Discover investment opportunities here.

Question time

We'd love to answer your questions, we'll have one of the OnMarket team or the company representative of the offer get back to you asap. So ask away ...

Would a Pronto Franchise be approved if the proposed location of the facility was within another Franchise or managed gym? For example, Surge Fitness, Snap or Anytime Fitness etc?

Brett R (OnMarket member) on 22/10/2024That's an interesting question Brett and we'd have to look into this and the specifics that you may have in mind to provide any meaningful feedback. I would however comment that Pronto is not offering a traditional franchise product. Our model for studio ownership is a commercial agreement where the Studio Owner controls the physical studio asset and appoints Pronto to operate their studio 100% for them. A passive investment and vastly superior to franchising in many ways. Find out more here: https://www.prontopilates.com.au/own-a-pronto-studio/

Stephen A (Pronto Pilates Pty Ltd representative) replied to Brett R on 22/10/2024Above it says that we cannot expect to liquidate our investment in the near future, which is understandable. But at what stage can we expect to receive a ROI or can we liquidate if we decide?

Joya W (OnMarket member) on 23/10/2024never mind, I have read the documents and my question is answered in there

Joya W (OnMarket member) replied to Joya W on 23/10/2024All good Joya!

Stephen A (Pronto Pilates Pty Ltd representative) replied to Joya W on 23/10/2024:)

Stephen A (Pronto Pilates Pty Ltd representative) replied to Joya W on 24/10/2024Hi Joya, we are planning to exit (IPO or sales to a Private Equity firm in 2028) and all shareholders can realise their gain at this time. Regards, Steve

Stephen A (Pronto Pilates Pty Ltd representative) replied to Joya W on 23/10/2024I am wondering what an estimate would be on dividends payed out in 2028 if I invested $1500. Thanks.

Rachel M (OnMarket member) on 23/10/2024Hi Rachael, I cannot say with absolute certainty. However, our plan is 1000 studios by 2028. I'd estimate a 20X+ growth in your share value if me and my team are successful in executing our growth plans. Regards, Steve Anson

Stephen A (Pronto Pilates Pty Ltd representative) replied to Rachel M on 23/10/2024Hi what is the pre-money valuation ?

mussaret n (OnMarket member) on 23/10/2024Hi Mussaret, pre-money valuation is $36M. Pages 42 - 43 in the Offer Doc covers valuation details. Regards, Steve

Stephen A (Pronto Pilates Pty Ltd representative) replied to mussaret n on 24/10/2024Thanks I missed that

mussaret n (OnMarket member) replied to Stephen A on 24/10/2024:)

Stephen A (Pronto Pilates Pty Ltd representative) replied to mussaret n on 24/10/2024Hi I was wondering why the FY24 financials are not signed and dated by the auditor?

mussaret n (OnMarket member) on 23/10/2024The FY24 financials were prepared by external Accountants but there is no requirement from ASIC for them to be audited. Steve

Stephen A (Pronto Pilates Pty Ltd representative) replied to mussaret n on 24/10/2024Thanks Stephen, I didn't explain my question properly, my apologies. I understand that given Pronto's current size it does not meet ASIC audit threshold. I'm nevertheless still surprised that given you had the accounts prepared by external accountants, that they were not signed by the accountant? I've not seen unsigned accountants before

mussaret n (OnMarket member) replied to Stephen A on 24/10/2024I can look into this further if you like? I responded with the answer from our CFO. Steve

Stephen A (Pronto Pilates Pty Ltd representative) replied to mussaret n on 24/10/2024hello, I was wondering you expect to have a positive net asset position?

mussaret n (OnMarket member) on 23/10/2024Hi again Mussaret... Net Asset position early next year due to investor-owned studio strategy. Steve

Stephen A (Pronto Pilates Pty Ltd representative) replied to mussaret n on 24/10/2024Thanks

mussaret n (OnMarket member) replied to Stephen A on 24/10/2024You are welcome and hope to have you join our journey to 1000 studios! :)

Stephen A (Pronto Pilates Pty Ltd representative) replied to mussaret n on 24/10/2024quick question, are you ESICs company which I can have tax benefit from ATO? cheers

Jack w (OnMarket member) on 25/10/2024Thank you for your question Jack. I replied to your email and we're definitely looking into this. ~ Steve Anson

Stephen A (Pronto Pilates Pty Ltd representative) replied to Jack w on 25/10/2024Hi any update on this Stephen?

David A (OnMarket member) replied to Stephen A on 07/11/2024Hi David, weve received external advice indicating that Pronto is likely eligible for the ESIC scheme, which could offer valuable tax benefits to our investors. Were planning to navigate the application process with the government to confirm this. Regards, Steve Anson

Stephen A (Pronto Pilates Pty Ltd representative) replied to David A on 08/11/2024What is Pronto enthusiast membership? And what do you get for the membership?

Anna W (OnMarket member) on 25/10/2024Hi Anna, you get 30 classes/mo. on the Enthusiast Plan. Check out all plans here: https://www.prontopilates.com.au/prices/ And, if you're new to Pilates, check out What to Expect here: https://www.prontopilates.com.au/what-to-expect/ ~ Steve Anson

Stephen A (Pronto Pilates Pty Ltd representative) replied to Anna W on 25/10/2024Thank you. So confirming if I invest $10k that comes with a lifetime enthusiast membership for no additional cost?

Anna W (OnMarket member) replied to Stephen A on 29/10/2024Correct Anna. The deal of the century :) ~ Steve Anson

Stephen A (Pronto Pilates Pty Ltd representative) replied to Anna W on 30/10/2024Hi, what measures do you have in place to protect the company for injury claims or litigation (especially with USA market opening soon ). Have you favored in additional insurance costs in those markets in your pricing ?

Deanne K (OnMarket member) on 28/10/2024I understand that 24 hour gyms are a similar business however these also often have a safety button to call for help. The pronto studio I visited only has a QR code to scan which doesn't really cut it in an emergency situation (injury or being attacked). Is this something you might address?

Hi Deanne,

Stephen A (Pronto Pilates Pty Ltd representative) replied to Deanne K on 28/10/2024Yes, member safety is our #1 priority, both in terms of studio location and class safety. We have comprehensive public liability insurance in place in Australia and are currently in discussions with U.S. providers ahead of our 2025 launch there.

As for our safety record, members have taken over 170,000 classes with only one insurance claim. While weve had a couple of instances of unauthorized entries, they havent led to any issues. Prontos environment is considerably safer than 24/7 gyms.

We explored having an emergency button linked to security but, on advice, decided to instruct members to call the Police directly in emergencies. Security companies would typically do this in the scenarios you mentioned.

Regards

Steve Anson

Hi so since you are a private company we are not actually getting shares that we can sell on ASX we are simply providing funds for you to grow ? So how would we sell them if we need to >

Janet G (OnMarket member) on 29/10/2024Hi Janet, our plan is to grow to 1000 studios and then either list of a stock exchange or sell to a Private Equity firm. This is when Pronto shareholders can realize their investment. We're inviting you to join us on this journey as we disrupt the global Pilates industry! ~ Steve Anson

Stephen A (Pronto Pilates Pty Ltd representative) replied to Janet G on 29/10/2024Do the studios pay Pronto for the monthly expenses and apart from the lease and electricity what are the other studio expenses?

Daniel de C (OnMarket member) on 03/11/2024Hi Daniel, studio owners only need to pay property-related expenses (rent and outgoings) and occasional future expenses inc. studio hardware upgrades and expansion member marketing campaigns. Studio ownership is deigned as a passive investment with world-class annual ROI of 70%+. By sharing the rewards of our high-performing business model with investors, this enables Pronto to accelerate expansion to our 1000 studios goal by 2028. Most studio owners are also investing in shares as a duel investment strategy. ~ Steve Anson

Stephen A (Pronto Pilates Pty Ltd representative) replied to Daniel de C on 03/11/2024Hi Pronto team -

MELISSA SUE A (OnMarket member) on 06/11/2024Just wanting to clarify; are all shares of the same class? E.g. are the shares currently owned by the Pronto exec team the same as the shares of the crowdfunding arm?

Thank you - Melissa

Hi Melissa. Yes, your Pronto shares will be "ordinary shares". Exactly the same class of shares as all shareholders. You can read about this on page 44 of our offer doc. Thank you for your interest and I hope you'll join our journey! ~ Steve Anson

Stephen A (Pronto Pilates Pty Ltd representative) replied to MELISSA SUE A on 07/11/2024Thank you! Yes I did see that; just needed to confirm I understood it correctly

MELISSA SUE A (OnMarket member) replied to Stephen A on 07/11/2024Welcome! Steve

Stephen A (Pronto Pilates Pty Ltd representative) replied to MELISSA SUE A on 07/11/2024Hi I have enquired about studio investment seperately through your website but have not heard back other than an autogenerated response, just after some general information please contact me seperately

David A (OnMarket member) on 07/11/2024Hi David, I'll look into this for you! Regards, Steve Anson

Stephen A (Pronto Pilates Pty Ltd representative) replied to David A on 07/11/2024I still havent heard from anyone

David A (OnMarket member) replied to Stephen A on 14/11/2024Hi David, will check again. ~ Steve

Stephen A (Pronto Pilates Pty Ltd representative) replied to David A on 14/11/2024Hi Steve.

Liz B (OnMarket member) on 12/11/2024How many new studios will be funded at the minimum and maximum subscription level?

i.e. will there need to be additional funding rounds to get to the 1,000 studios.

Thanks

LIz

Hi Liz, between our investment and this current capital raise, we do not perceive any need to raise additional funds to achieve our 1000 studio goal. Pronto studio economics return excellent profits that will be reinvested to fund growth! ~ Steve Anson

Stephen A (Pronto Pilates Pty Ltd representative) replied to Liz B on 12/11/2024Hi Steve

Liz B (OnMarket member) on 12/11/2024Does the Vortala group already operate in the US?

Yes Liz, 70% of Vortala's revenue is generated from North America. Across our team of 140, around 50 are located in the US and Canada. So we have an established team ready for Pronto to attack this market (50% of global Pilates demand). We're gearing up to launch in the US in Q1 of 2025. ~ Steve Anson

Stephen A (Pronto Pilates Pty Ltd representative) replied to Liz B on 12/11/2024What are your thoughts regarding Tump winning and not wanting outside companies to flourish in USA?

Melinda W (OnMarket member) on 13/11/2024Interesting question Melinda. Pronto's parent company (Vortala) has been trading in the US for 20 years. 60% of our revenue is USD and we employ about 50 people there. I don't perceive any significant friction with Pronto getting going in the US. Actually, a few of our US team members have been in AU recently to get immersed in Pronto... they are extremely positive about our model being very well received in the US. ~ Steve Anson

Stephen A (Pronto Pilates Pty Ltd representative) replied to Melinda W on 14/11/2024Thank you!

Melinda W (OnMarket member) replied to Stephen A on 15/11/2024:)

Stephen A (Pronto Pilates Pty Ltd representative) replied to Melinda W on 15/11/2024Hi Team,

Joya W (OnMarket member) on 14/11/2024I was wondering when can we expect to get our investor rewards, such as the T-shirt, grip socks, and membership?

Hi Joya, thank you for your investment! We will organise investor rewards after your shares are issued. Please stay tuned to learn more about timing. ~ Steve Anson

Stephen A (Pronto Pilates Pty Ltd representative) replied to Joya W on 14/11/2024Hi there, I have just seen this opportunity and would love to invest 10k but don't have enough time to be approved as a sophisticated investor. Is there anyway I could still get the lifetime membership if I invest $9995 assuming as shares are $5 that's the most I can invest. I hope you can help me out! Thanks

Katharine G (OnMarket member) on 15/11/2024Hi Katharine. I believe you can invest $10k without a wholesale investor certificate. Please connect with Carla (carla@onmarket.com.au) and she can assist with any details today (last day). Look forward to welcoming you as a shareholder! ~ Steve Anson

Stephen A (Pronto Pilates Pty Ltd representative) replied to Katharine G on 15/11/2024Thanks Steve! I've figured it out :) I look forward to being part of the journey!

Katharine G (OnMarket member) replied to Stephen A on 15/11/2024.

Stephen A (Pronto Pilates Pty Ltd representative) replied to Katharine G on 15/11/2024Enquiring when six-month membership reward would be available? So I can figure out how to continue my membership

Richard B (OnMarket member) on 17/11/2024Hi Richard, we don't have an exact timeline yet. But I expect that ahead of the New Year, all rewards will be formalized with investors. Thanks for investing in Pronto! ~ Steve Anson

Stephen A (Pronto Pilates Pty Ltd representative) replied to Richard B on 20/11/2024Please sign in to post a question