Developing and commercialising products for the repair of damaged peripheral nerves

Live ReNerve Ltd ASX: RNV

ReNerve Ltd IPO | ASX: RNV

The IPO has received strong investor interest and may close early. OnMarket has a limited allocation.

The offer may close early and the 'Pay By' dates may change. Duplicate bids under the same investment profile, investor name or residential address may be cancelled.

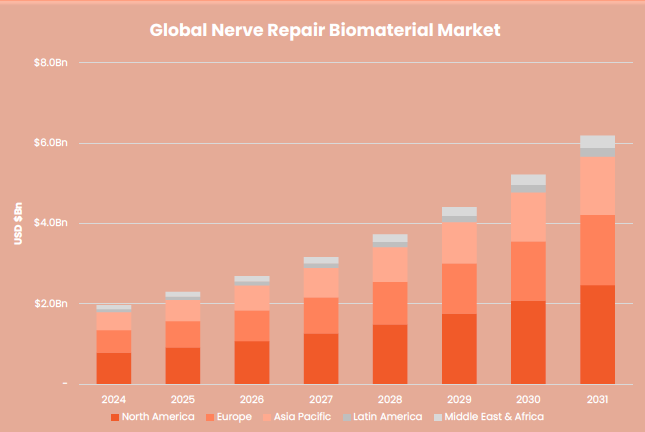

Investment Highlights

Introduction

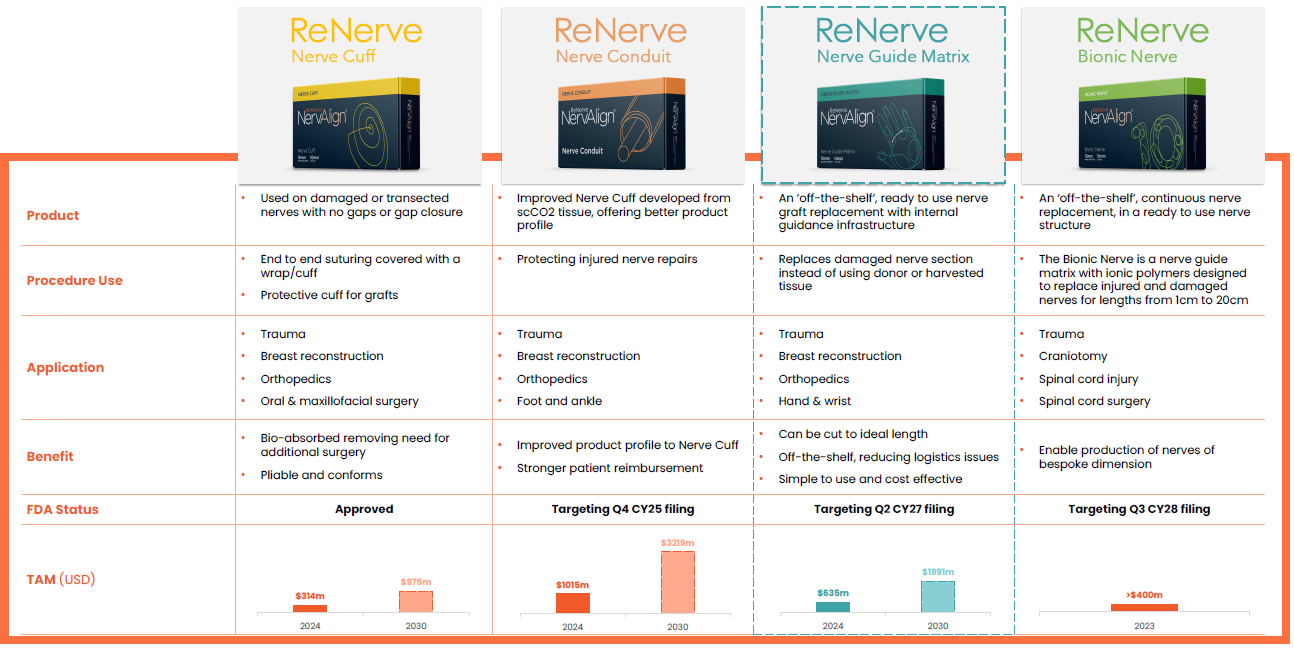

ReNerve Ltd is focused on developing bio-material based medical devices to deliver superior outcomes in the treatment of peripheral nerve injury (PNI) and related applications. The global market for bio-material based devices for the treatment of PNI is growing rapidly from an estimated US$1.68 billion in 2023 to US$6.19 billion by 2031, representing a compound annual growth rate (CAGR) of 17.8%.

PNIs have serious consequences for patients, including deterioration of motor and sensory function, ongoing pain, and over the longer term diminished mental health and independence. Unfortunately, patients are poorly served by the products and surgical procedures that are the current standard of care, many of which were originally developed for other applications, are not easy for surgeons to use, or deliver sub-optimal therapeutic outcomes.

ReNerve aims to deliver significantly better patient outcomes by developing and marketing a comprehensive portfolio of bio-material based medical devices specifically designed for PNI treatment. In particular, the devices have been designed for ease of use in surgery. They are based on bio-materials that incorporate technology specifically developed to promote nerve regrowth through providing an optimised, clean and debris-free environment, minimising scarring and the negative effects of inflammation.

ReNerve’s first product, the NervAlign® Nerve Cuff, has received regulatory clearance from the United States Food and Drug Authority (FDA) and has been launched in the US market. The Company has secured product approval for the NervAlign® Nerve Cuff in a growing number of US hospitals and seen the cuff used successfully in more than 100 surgical procedures across a range of applications. The NervAlign® Nerve Cuff has demonstrated excellent therapeutic outcomes and has received strong endorsement from a number of leading nerve repair surgeons. The NervAlign® Nerve Cuff is achieving strong sales growth as ReNerve continues to accelerate sales presence in key US hospital systems.

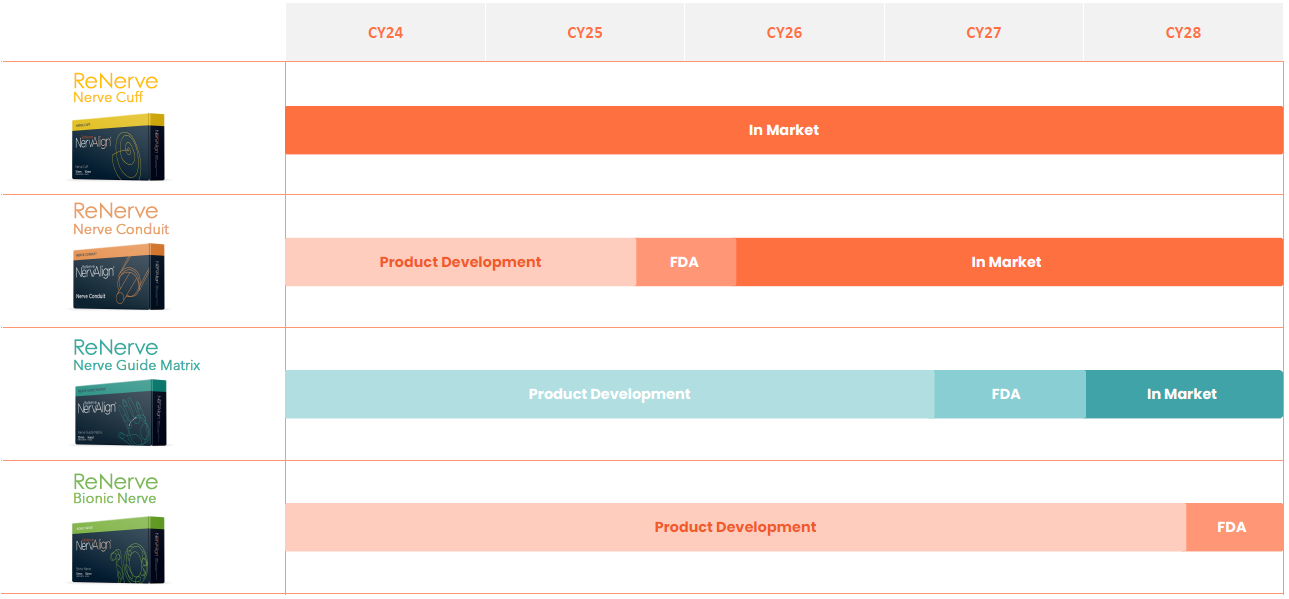

The Company has three further products at various stages of development, all focused on delivering superior outcomes in the treatment of peripheral nerve injury and related applications. These products will be developed and commercialised under the NervAlign® brand, aimed at positioning ReNerve to become a leading supplier in the nerve repair biomaterials market.

ReNerve’s strategy is to develop and commercialise its portfolio of medical devices and leverage product development skills, proven technology and established US-based logistics and sales infrastructure to grow its business in the USA, with an opportunity to address other markets globally.

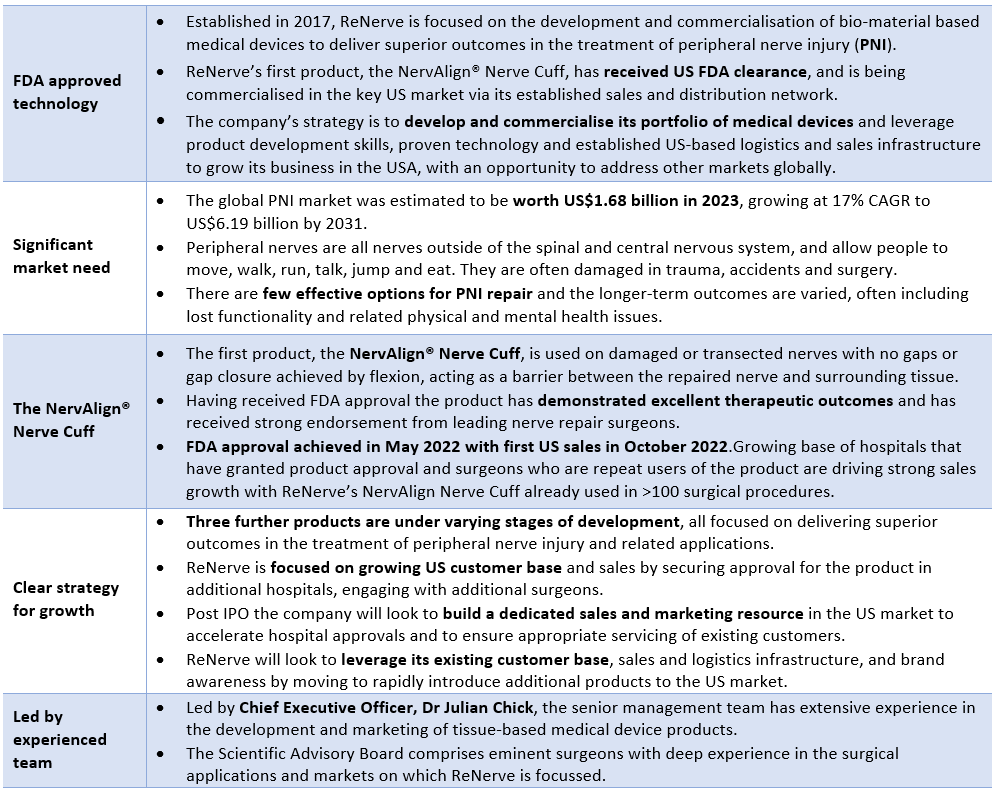

ReNerve’s product range

Offer Overview

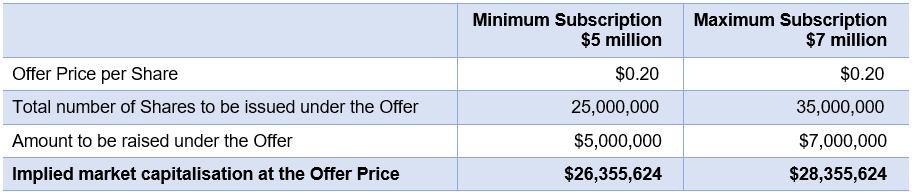

ReNerve Ltd is looking to undertake an IPO on ASX to raise between $5 million and $7 million via the issue of between 25 million and 35 million shares at an offer price of $0.20. The company will have an implied market cap of $28.36m at the maximum subscription.

Industry Overview

ReNerve Ltd operates in the nerve treatment and replacement market, and more specifically, in the PNI market.

Functioning peripheral nerves help people move, eat, walk, and jump and are the movement and sensation nerves throughout the body and limbs. While PNI is most often associated with trauma, nerves can be injured in other ways, such as during or after surgery. PNI adversely affects sensation and muscle control and movement, often with chronic pain. Full recovery is uncommon, and outcomes post-surgery are varied. Negative symptoms commonly persist, affecting long term quality of life. Emotional and mental health issues such as depression are common.

Although surgeons do have access to products for some nerve injury repair procedures, the outcome of these procedures can vary considerably. ReNerve is focused on developing cleaner, safer, and better products to reduce patient recovery times and deliver improved outcomes, targeting return to native functioning nerves.

ReNerve competes in the global nerve repair and surgical reconstruction markets. The global market for biological medical devices for peripheral nerve injury repair was valued at USD$1.68Bn in 2023 and is forecast to grow to US$6.19Bn in 2031, representing a compound annual growth rate (CAGR) of 17.8% (Global Nerve Repair Biomaterials Market Research Report, 2020-2031).

Global nerve repair biometric market

Company Overview

ReNerve is a company focused on developing and marketing medical devices to enhance surgical procedures and patient outcomes for invasive nerve surgery. ReNerve was established to develop a portfolio of products for hand and wrist, foot and ankle, breast, neuro and plastic surgeons to produce better patient outcomes in the repair and replacement of peripheral nerves. ReNerve proposes to deliver better patient outcomes by developing and selling products that will:

- protect nerve regrowth from scarring and the negative effects of inflammation;

- provide an ideal, debris free environment for the nerves to regenerate and re-establish nerve function back to native condition;

- minimise the risks of post-surgery complications and longer-term detriment to the patient; and

- offer convenience and surgical ease of use to surgeons engaged in peripheral nerve injury repairs.

ReNerve’s strategy is to develop and commercialise a broader portfolio of medical devices focussed on nerve repair. ReNerve plans to leverage its demonstrated product development skills, proven technology and established US-based logistics and sales infrastructure to rapidly grow its business in the USA, with an opportunity in the next 12 to 24 months to address other markets globally.

Products

The outcomes from nerve injuries vary. The greater the damage (including the length of damaged nerves), the poorer the outcome for patients as there are fewer options available to surgeons. ReNerve is developing a portfolio of tissue-based nerve repair products that are cleaner and safer than current alternatives and aim to deliver better outcomes for patients. These products target the repair and/or replacement of peripheral nerves that have been injured following trauma, malignancy or surgery. The products are designed to be practical for the surgeon, offering ease of use as well as reducing hospital waste and expenditure.

To offer newer, better solutions, ReNerve has four key products, each of which is at a different stage of development and commercialisation.

NervAlign® Nerve Cuff

ReNerve’s first product is the NervAlign® Nerve Cuff. This product was developed based on the eCOO™ Technology over a period of 4 years of development collaboration between ReNerve and Leader / EMCM. The product was cleared by the FDA as a medical device in February 2022 and is currently being manufactured by EMCM from porcine tissue which is cleaned using the eCOO™ Technology.

The ReNerve NervAlign® Nerve Cuff is a pliable, semi-permeable, resorbable membrane made of collagen designed to protect traumatised but intact nerves, sutured and short gap nerve repairs where ends have been re-approximated, and suture sites of nerve grafts. The tissue product is biodegradable and is designed to protect from scarring and excess inflammation, while allowing nutrients and neurotrophic factors to pass through to facilitate nerve repair.

Studies have shown that when the ReNerve NervAlign® Nerve Cuff was implanted around nerves, no neuroma formation was observed (neuromas are often painful and are a disorganized growth of nerve cells at the site of a nerve injury), there were no adverse changes to the nerves, the cuff was fully resorbed and allowed for full recovery of the nerve after six months. The ReNerve NervAlign® Nerve Cuff is highly rated for its pliability and use in surgery. The Nerve Cuff is currently in market in the US and New Zealand.

NervAlign® Nerve Conduit

The NervAlign® Nerve Conduit is expected to be its second product to market It is used in the repair of injured peripheral nerves where a small gap occurs due to the removal or loss through injury of a small amount of damaged nerve. Nerve conduit products have the benefit in the US market with a higher rate of reimbursement compared to nerve cuff products, and therefore tend to be used more frequently in some hospital systems.

NervAlign® Nerve Guide Matrix (graft)

ReNerve is currently in the early stages of developing its Nerve Guide Matrix product. The NervAlign® Nerve Guide Matrix is intended to be a size-based range of ‘off-the-shelf’ Nerve Guides for the repair of damaged nerves, as alternatives to autologous harvested nerves and donor nerves.

NervAlign® Bionic Nerve

ReNerve has commenced the process of developing a ‘bionic’ nerve graft (Bionic Nerve) to repair long nerve gaps. The initial prototypes are assessing natural collagen fibre and polymer technologies, with the goal to have an ‘off-the-shelf’ nerve that can be cut to measure to replace damaged nerves. Currently there is no effective option for surgeons in the replacement of longer nerves (>3-5 cm), with current options (donor or autologous tissue) providing inconsistent, sub-optimal outcomes.

Distribution model

The Company’s path to profitability will be through the approval and sale of its products, initially into the US market and subsequently into other jurisdictions. The sale of its on-market NervAlign® Nerve Cuff is the first step in this process.

One of the key activities for ReNerve over the past few years has been building manufacturing, logistics and sales and marketing infrastructure, which can now be used for all the products in development.

ReNerve‘s current go-to-market strategy relies on a distributor model, which involves low fixed costs and lower levels of capital investment in sales and marketing. The Company has already partnered with several distributors in the US and gained significant insight into identifying the most effective distributors. ReNerve intends to continue to expand its sales network via this channel over the next 6 to 12 months. The Company will work with surgeons to continue to validate its products’ functionality and therapeutic benefit, and use this supporting evidence to assist the sales network.

A key factor in delivering product sales growth in the US market is ensuring hospital entrance and reimbursement. Both the NervAlign® Nerve Conduit and the NervAlign® Nerve Guide Matrix are covered under existing Current Procedural Terminology (CPT) coding, which covers nerve repairs and nervous system procedures. For non-US reference, the Company will use the Global Medical Device Nomenclature (GMDN). In the US, its NervAlign® Nerve Cuff cost is covered under the diagnosis-related group (DRG) system where the entire procedure is funded, including the cost of materials such as nerve cuffs.

Commercialisation Strategy

Following the successful release of the NervAlign® Nerve Cuff in the US market and the development of logistics and sales and marketing infrastructure to support that product, ReNerve’s growth strategy has two main components:

- ReNerve will continue to focus on growing its US customer base and sales of the NervAlign® Nerve Cuff, by securing approval for the product in additional hospitals, engaging with additional surgeons who have the potential to be repeat users of the product, and publishing the results of studies currently underway to demonstrate the superior utility of the NervAlign® Nerve Cuff in various nerve repair applications. ReNerve will consider investing in dedicated sales and marketing resources in the US market to accelerate hospital approvals and to ensure appropriate servicing of existing customers.

- ReNerve will leverage its existing customer base, sales and logistics infrastructure, surgeon support and brand awareness by moving to rapidly introduce additional products to the US market. In particular, ReNerve expects that it will be able to gain regulatory approval for and commence marketing of the NervAlign® Nerve Conduit at relatively low cost and low risk on an expedited basis, given the demonstrated safety profile of the eCOOTM Technology on which the product is based. ReNerve plans to follow that with the release of the NervAlign® Nerve Guide Matrix.

ReNerve Commercialisation Timeline

Competitive advantages of ReNerve products

Historically, many tissue-based medical devices have entered the market as extensions from their original intended medical application. However, the physiological characteristics required for repairing peripheral nerves are not necessarily the same as the requirements for repairs of other injuries. As a result, many nerve repair products currently on the market have sub-optimal characteristics. By contrast, ReNerve is developing its products with a view to addressing the specific physiological and clinical requirements for repairing nerve injuries.

As a result of a targeted product development program, the ReNerve products aim to provide both surgical convenience and better patient outcomes. In particular, ReNerve’s products are designed and engineered to deliver:

- therapeutic advantages and superior patient outcomes, with the following advantages:

- specifically designed for treatment of PNI

- clean and green

- minimisation of scarring

- promotion of nerve re-growth

- full absorption through natural body processes

- convenience and ease of use for surgeons – designed with surgery in mind

- low cost, thus allowing competitive pricing

Overall, ReNerve is aiming to build a competitive position in the market with a comprehensive portfolio of products to offer to surgeons. Given that all the ReNerve products are being designed to be stored at room temperature, they provide surgeons the flexibility in theatre to select the product best suited for any particular peripheral nerve injury repair. The breadth of the product range will mean that ReNerve’s products will provide solutions for all possible patient repairs.

Board and Management

ReNerve Ltd are led by a highly experienced board and management team with extensive experience launching and commercialising new medical products both in Australia and globally. This includes:

Julian Chick – Executive Director / Chief Executive Officer

Dr Julian Chick is an experienced healthcare executive with over 25 years’ experience in senior management including in ASX listed companies Avexa and Admedus. His roles have included Chief Executive Officer, COO and Head of Business Development, as well as running early and late stage R&D projects and launching medical devices into the global markets. Dr Chick while COO at Admedus Ltd was involved in the R&D development, regulatory approval and launch of several tissue products in North America, Europe and Asia. He has ten years’ experience in investment banking and advisory and has also held a role as an analyst reviewing healthcare and biotechnology investment opportunities for private equity investors and venture capitalists.

David Rhodes - Executive Director / Chief Scientific Officer

Dr David Rhodes has more than 20 years’ experience in the healthcare and biotechnology industries, where he has held numerous senior management roles and developed technologies through to market approval. Previous roles include senior researcher at Amrad, Chief Scientific Officer of the medical devices company Admedus Ltd, senior executive and Head of Drug Discovery and Senior Vice President of Biology at Avexa Ltd. Amrad, Admedus and Avexa were all ASX-listed companies. Dr Rhodes has successfully led multiple technology development programs attracting significant levels of funding from many State and Federal Government initiatives and research institute programs.

Stephen Cooper - Chairman

Stephen Cooper is a director of Grant Samuel Group Pty Limited, a leading independent Australian investment banking business. Stephen has over twenty-five years of experience in investment banking and has been responsible for numerous corporate advisory assignments including public company takeovers, mergers, business sales and acquisitions, schemes of arrangement, capital raisings and business valuations. He has served as the chairman of an ASX-listed biotechnology company, Avexa Ltd.

Michael Panaccio – Non-Executive Director

Michael Panaccio is one of the founders of Starfish Ventures, a venture capital firm that invests in early-stage technology companies and plays an active role in the management of its portfolio. Michael has been a director of numerous technology businesses in Australia and the USA including SIRTeX Medical Ltd, Engana Pty Ltd (acquired by Optium Inc), Energy Response (sold to EnerNoc Inc), ImpediMed Ltd, and Protagonist Therapeutics Inc. He currently serves on the boards of dorsaVi Ltd, MetaCDN Pty Ltd, Margin Clear Pty Ltd, Marp Therapeutics Pty Ltd and Cylite Pty Ltd. Dr Panaccio will be a non-executive Director. Dr Panaccio is currently a non-executive Director on ASX listed dorsaVi Ltd (ASX:DVL).

David Lilja - Chief Financial Officer and Company Secretary

David Lilja (B.Bus, MBA, CTA, MIPA) is a qualified accountant and experienced company secretary with over 20 years’ experience within the professional services industry working closely across a wide range of industries. David will supply his services through his firm, DLK Advisory, which provides a breadth of support to its clients including outsourced CFO and Company Secretary services. The Company does not consider that its current level of operations justifies it retaining a full time CFO and company secretary.

Key Offer Statistics

See ‘Summary of Offer’ section of the Prospectus for further information.

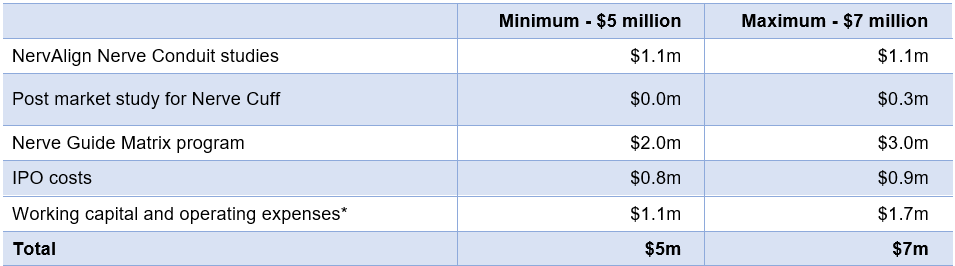

Use of Funds

Funds raised from the Offer will be applied as follows:

For further information on the Key Offer Statistics and Use of Funds, please see the prospectus.

Risks

You are encouraged to read the Prospectus carefully as it contains detailed information about the Company and the Offer. Like all investments, an investment in ReNerve Ltd carries risk. As set out in Section 6 of the prospectus, ReNerve Ltd is subject to a range of risks, including but not limited to research and development program, rejection or delay in receiving regulatory approval, non-acceptance of ReNerve products by surgeons, loss of EMCM exclusivity, termination of agreements, manufacturing and production, competition, copycats, IP and product recall.

Section 734(6) disclosure: The issuer of the securities is ReNerve Limited ACN 614 848 216. The securities to be issued are ordinary shares. The disclosure document for the offer can be obtained by clicking on the link above. The offers of the securities are made in, or accompanied by, a copy of the disclosure document. Investors should consider the disclosure document in deciding whether to acquire the securities. Anyone who wants to acquire the securities will need to complete the application form that will be in or will accompany the disclosure document (which can be done via the electronic application form which will become available by clicking the bid button above).

OnMarket has a limited allocation. The offer may close early and the 'Pay By' dates may change. Duplicate bids under the same investment profile, investor name or residential address may be cancelled.