Empowering visionary technology founders to transform their ideas into the great businesses of tomorrow

Live Scalare Partners Hold. Ltd ASX: SCP

Scalare Partners Holdings Ltd | ASX: SCP

This offer is only open to investors that fall within the Target Market.

If you are a retail investor, you must complete the Target Market Determination (TMD) Questionnaire before your application will be processed.

The purpose of the TMD Questionnaire is to assess whether an investment in this offer is likely to be consistent with your objectives, financial situation and needs.

Key Investment Highlights

Introduction

Scalare Partners Holdings Ltd (ASX:SCP) was established to empower visionary tech founders to transform their ideas into great businesses by providing support, delivered through products, services and expert advice alongside investment in selected early-stage technology businesses. Since starting in January 2020, Scalare invested in 30 companies across multiple technology sectors and 6 countries and supported 58 companies with 69 separate engagements.

Scalare is deeply embedded in the broader technology ecosystem, driving change through impactful initiatives such as the Australian Technology Competition, the recently acquired Tech Ready Women and its "Be the Change" program where Scalare together with Federal and State governments and corporates support and promote the most promising technology businesses and founders. Its focus extends to working with female and culturally diverse founders, addressing the specific challenges they encounter in fundraising and scaling their businesses. This engagement not only enriches the tech landscape but also creates revenue and investment opportunities for Scalare.

A key Scalare difference is that it is actively involved in the ecosystem and within its portfolio companies to help them navigate from early growth stage through to an eventual exit. While Scalare has significant flexibility in its investing activities, its core investment strategy is to target minority positions in unlisted technology companies, that it considers to be in the early growth-stage of their development.

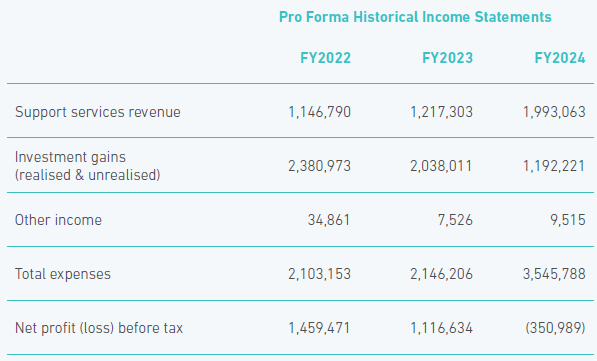

In FY2023, support services and product revenue has grown to $1.99 million, increasing over 60% from FY2023.

Scalare operates its services business through four separate business units, being Scalare Partners, Tech Ready Women, the Australian Technology Competition and its recently launched Ascend.

Overview of the Offer

The issuer of the prospectus is Candy Club Holdings Ltd (ACN 629 598 778) (to be renamed Scalare Partners Holdings Ltd). Scalare Partners Holdings Ltd will trade under the ticker ASX: SCP. For more information, please refer to the Prospectus.

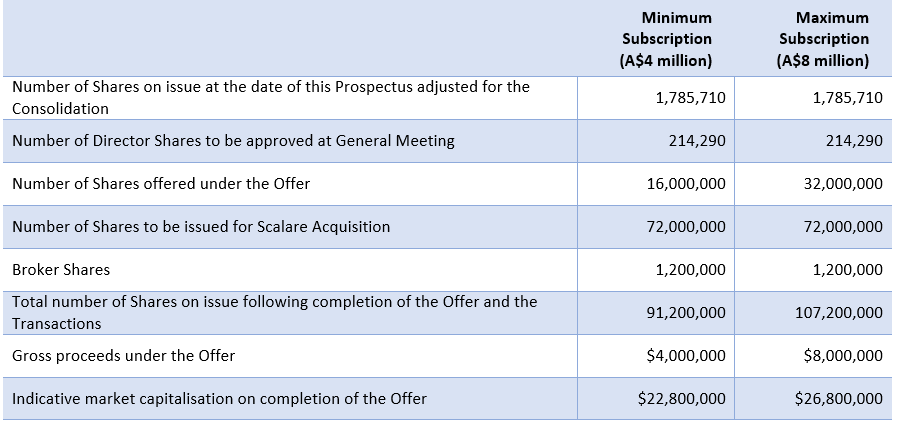

Scalare Partners Holdings Ltd is looking to undertake an IPO on ASX to raise between $4 million and $8 million via the issue of between 16 million and 32 million shares at an offer price of A$0.25 per share. The company will have an indicative market capitalisation of approximately A$26.88 million at maximum subscription.

Part of the funds Scalare is raising under this Offer is to fast track the digitalisation of services so Scalare can continue to scale and build recurring revenue streams faster.

Industry Overview

Scalare supports and invests in early-stage technology businesses with local and global growth potential, therefore sits within the Australian technology sector. Australia has created a start-up friendly business environment, which has led to a thriving sector with a growing number of innovative companies, events, accelerators, and community and government support systems. The Australian technology sector grew by almost 80% from 2016-2021 to A$167 billion and is expected to reach the value of A$250 billion by 2030.

In 2023 there were 413 reported deals bringing start-ups $3.5 billion in funding (dropping from $7.4 billion in 2022. This was reflective on the global trend in the early-stage technology investment sector. The drop in funding led to a shift in focus for start-up founders.

Business founders needed to adapt and stay agile by refocussing on accessing external assistance where-ever possible with outsourced services and collaboration. However, a recently published report by Cut Through Ventures showed that Q2 CY2024 marked a significant recovery in the Australian startup funding landscape, delivering the strongest funding quarter since Q4 2022. The total deal count increased, signalling renewed investor activity across all stages.

Company Overview

Scalare Partners is an Australian company incorporate in 2020 and was established to assist and empower visionary technology business founders to transform their ideas into the successful technology businesses of tomorrow. At the heart of the Scalare business model is the provision of products, services, expert advice and investment in early-stage technology businesses. Scalare aims to be the trusted partner of early-stage technology business founders so it is able to assist them build more successful businesses through the provision of products and services including:

- Training and education solutions via a range of digital programs

- Commercial – build and lead the go to market strategy, optimise pricing models, streamline customer journeys and maximise market potential.

- Capital raise – provide expert guidance to plan capital raisings as well as help to secure or lead funding rounds, creating compelling pitches and meeting investor expectations.

- Accounting and finance – developing the right financial strategy with accurate accounting services, focussing on accurate forecasting and optimal cash burn rate management.

- Marketing – develop impactful marketing strategies to build a brand, enhance visibility and drive customer acquisition

- Product and technology – ensure the product roadmap is robust and avoid Tech Debt with Scalare’s expert guidance and strategic support

- Corporate governance – implement strong yet sensible corporate governance practices for each businesses’ stage of growth and maturity to build ethical operations and investor confidence

- People and culture – create a thriving culture to attract top talent and implement effective HR practices for sustained growth with a strong diversity and inclusion focus

- Operations – build on existing business operations with our expert support to drive efficiencies, scalability and seamless growth.

- Mentoring and education – through Tech Ready Women and the recently launched Ascend programs.

- Market awareness – through the annual Australian Technologies Competition

To fulfill this aim Scalare has developed a community of business founders, advisers who are available to work closely with founders of technology companies and businesses as well as investors who are interested in investing directly in start-up technology companies.

Scalare charges fees for the provision of these products and services, which are the basis of the operating revenue of the business. Scalare allocates capital from its own balance sheet to invest in a selection of its customers. The realised and unrealised gains (and losses) is the basis of the other main revenue stream of the business

Business and Growth Strategy

Scalare provides support products and services and invests directly in early-stage technology businesses with local and global growth potential. Scalare generates revenue from the provision of products and services and generates investment returns from making investments into early-stage businesses which Scalare considers to have significant growth potential. A portion of profits generated through the provision of products and services will be reinvested each year into new investments to continue to build our portfolio of early-stage investments.

As Scalare invests directly from its own balance sheet it does not manage an investment fund. Therefore, unlike investment funds Scalare does not charge its shareholders fund management fees or “carry” to have an indirect interest in the companies it invests in, The Group will look to deliver returns to shareholders through continuing to build a profitable products and services business and through ongoing investment returns.

Scalare’s vision is to build a differentiated and derisked business model which assists and empowers visionary technology business founders to transform their ideas into the successful technology businesses of tomorrow through the provision of support products and services and potential investment. Scalare has appointed a highly experienced board and management team to deliver on these activities.

During FY2024 Scalare supported 58 companies with 69 separate paid for service engagements. Since incorporation in January 2020 Scalare has invested in 30 companies across 6 countries.

Investment Approach

Scalare’s approach to investment is to:

- build a portfolio through investing in early-stage technology companies that meet Scalare’s investment criteria and where talented founders are addressing large global market opportunities;

- deliver sustainable long term returns to Shareholders from the realisation of capital gains generated from its portfolio;

- support these longer term returns by building recurring revenues from the provision of products and services that generate cash for new and ongoing investments in early-stage technology companies;

- limit initial investments to a maximum of $250,000 per company;

- invest in a diversified portfolio across a large number of high growth, technology companies;

Scalare intends to offset some of the risks of investing in early-stage technology companies (a highly speculative asset class) in a number of ways. This includes the following:

- investing no more than $250,000 (historically averaged $122,000) in each company so any individual company failure is unlikely to be material;

- following an established investment process to identify the most promising investment opportunities

- investing across diversified technology sectors;

- investing alongside other reputable investors who can assist the companies with additional funding and/or advice;

- by providing products and services to the portfolio companies where the revenues for these products and services can ultimately be greater than the original amount invested.

Scalare’s current investment portfolio

Revenue

Since starting in January 2020, Scalare has invested $3.43 million in 30 companies and had three full and one partial exit. The current portfolio of 27 companies is valued at $10.23 million. These investments were funded from revenues generated and previous capital raises conducted by Scalare.

Scalare generates revenue from two main sources, being:

- Paid for support via products and services for early stage, high growth technology companies

- Investment gains and losses (realised and unrealised) from investment in a selection of these technology companies

To generate these revenue streams the key expenses consist of the team to deliver the digital products and services platform and the actual services as well as manage the investment process and ongoing support of portfolio companies. All support products and services are invoiced and received in cash.

Since appointing CEO, Carolyn Breeze in February 2023, Scalare has seen an acceleration in the go to market execution and operational activities.

This acceleration has seen Scalare work with 58 companies in FY2024, up from 30 in FY2023. The number of paid support service engagements has also increased from 39 to 69 in FY2024, with corresponding services revenues growing by 51% to over $1.6 million. On a pro forma basis, total revenues for FY2024 was $1,993,063.

Board and Management

Scalare Partners is led by an experienced operational and management team supported by a strong board of directors with experience and skills, including industry and business knowledge, financial management and corporate governance experience.These include:

Adelle Howse – Non-Executive and Independent Chair

Adelle has extensive executive and non-executive experience in the corporate and consulting environment with a focus on strategy, M&A and governance and has spent more than 20 years in energy and resources, construction, infrastructure, data centres, telecommunications, property sector and invests and advises early stage technology companies. Adelle currently holds board roles as a Non-Executive Director at Macquarie Technology Group Limited (ASX: MAQ), Sydney Desalination Plant, Downer EDI Limited (ASX: DOW), and BAI Communications.

Neil Carter - Non-Executive and Independent Director

Neil is an accomplished and well-known investor with over 25 years in financial markets. He was Co-Head of Global Listed Equities at IFM and a Divisional Director at Macquarie Funds Group, with an investment track record of strong over performance over 15 years. Neil built the IFM Listed Equities business to 28 people, $45bn in funds under management and a global footprint across active, passive, long and long-short funds.

James Lougheed - Non-Executive Director

James is a technology executive with nearly 30 years’ experience in electronics and semiconductors with diverse operational experience with roles in design, operations, quality, sales, marketing, executive management, board governance and technology investment & advisory.

Beau Quarry - Non-Executive Director

Beau founded property credit fund Solido Capital and is the Managing Director of venture capital fund Baobab Investment Management.

James Walker - Executive Director and Co-Founding Partner

James is an entrepreneur and investor specialising in fast growing businesses with experience as a ASX company director and leader in commercialising technology in new markets. James is currently a non-executive chair with BluGlass (ASX:BLG) and Native Mineral Resources Holdings (ASX: NMR), a non-executive director of Candy Club Holdings (ASX: CLB) and an executive director at Scalare Partners Pty Ltd. More recently James successfully completed the ASX-IPO of thedocyard (ASX: TDY) and Native Mineral Resources Holdings (ASX: NMR) and before that DroneShield (ASX: DRO).

Carolyn Breeze - Chief Executive Officer

Carolyn has over 20 years of experience in telecommunications, technology, eCommerce, and fintech, and has received numerous accolades for her work, including CEO Magazine’s IT and Telecommunications Executive of the Year (2018), Business Insider’s top 21 Women in Fintech, and the Advocate for Women award at the 2019 Woman in Payments Symposium. Most recently, Carolyn was recognised as Fintech Leader of the Year at the 2021 Woman in Finance Awards. Previous roles include CCO of Zepto, GM Aus/NZ of GoCardless, Australian Country Manager of Braintree and roles at PayPal and eBay.

Nicholas Roberts – Co-Founding Partner

Nick is an entrepreneur and investor specialising in fast growing technology businesses with international potential. Nick co-founded DataNet Marketing Services, a leading B2C content provider which was acquired by 365 Corporation Plc in 2000, then co-founded Complinet, a global B2B regulatory technology business acquired by Thomson Reuters Corporation in 2010. Nick was then CEO of RISQ Group, an APAC background screening which was sold to the US based Sterling Backcheck in 2016.

Giles Bourne – Co-Founding Partner

Giles has over 27 years of experience leading technology innovation and commercialisation across diverse industries, including multinational software companies, polymer banknote technology, and corporate advisory before being the CEO of BluGlass (ASX: BLG). At BluGlass he completed multiple ASX capital raises and delivered multiple international development partnerships.

Jenny Li – Chief Financial Officer and Partner

Jenny is a strategy focused and results orientated finance leader, with more than 15 years’ experience in improving financial governance, working in and advising multinational business to high growth start-ups undertaking rapid change and growth. Prior to joining Scalare Jenny was at Sterling RISQ as Finance Director.

Timothy Griffiths – Partner

Tim is a seasoned technology entrepreneur and executive with a rich background spanning over two decades in Silicon Valley and beyond. As a Partner at Scalare Partners since September 2021, Tim leverages his extensive experience in venture capital-backed start-ups, technical engineering, and entrepreneurial leadership to drive business growth and transformation.

Catriona Glover - Company Secretary

Catriona has over 25 years’ experience in corporate and commercial law with a focus on corporate governance and company secretarial advice for both listed and unlisted companies. Catriona has provided legal, corporate governance and company secretarial advice to several companies in a wide range of industries including mining, education, manufacturing, technology and not-for-profit organisations.

Key Offer Statistics

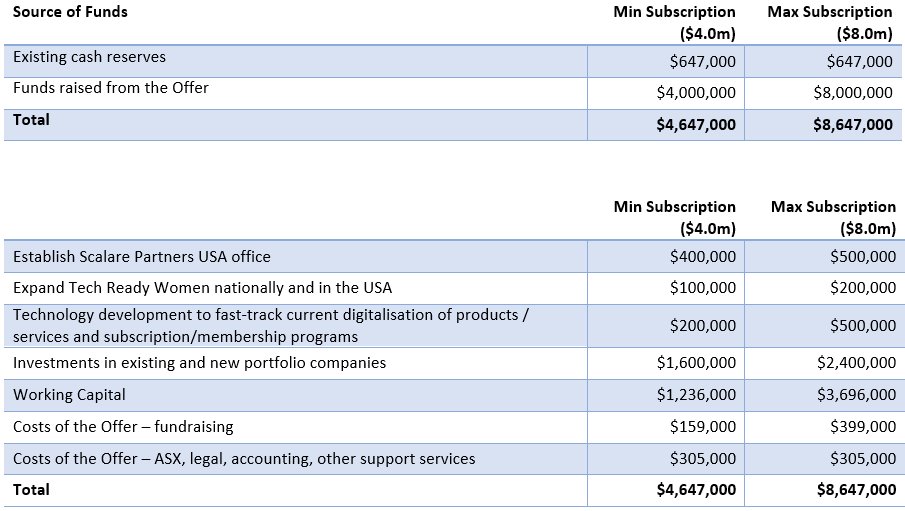

Use of Funds

Funds raised from the Offer will be applied as follows:

For further information on the Key Offer Statistics and Use of Funds, please see the prospectus.

Target Market Determination (TMD)

In accordance with the design and distribution obligations under the Corporations Act, Candy Club Holdings Ltd (ACN 629 598 778) (to be renamed Scalare Partners Holdings Ltd) or the “Company” has determined the target market for the Offer of the Shares under this Prospectus, and has prepared a Target Market Determination (TMD). The TMD is designed to help investors understand the class of consumers for whom the Offer of Shares is most suitable. The TMD is available here.

If you are a retail investor, the Company has developed a Consumer Attributes Questionnaire for potential investors to complete. Your responses to the Consumer Attributes Questionnaire will help the Company determine if you fall within that target market. You will be required to fill in the Consumer Attributes Questionnaire (available here) here before your application is processed.

The information set out in the table below summarises the overall class of investors that fall within the target market for the Shares, based on the key attributes of the product and the objectives, financial situation and needs that they have been designed to meet. The Shares have been designed for investors whose likely objectives, financial situation and needs are aligned with this product.

Risks

You are encouraged to read the Prospectus and Target Market Determination (TMD) carefully as it contains detailed information about the Company and the Offer. The TMD is designed to help investors understand the class of consumers for whom the Offer of Shares is most suitable. The Company has developed a Consumer Attributes Questionnaire for potential investors to complete. Responses to the Consumer Attributes Questionnaire will help the Company determine if investors fall within that target market.

Like all investments, an investment in Scalare Partners Holdings Ltd carries risk. As set out in Section 7 of the prospectus, Scalare Partners Holdings Ltd is subject to a range of risks, including the US expansion risk where Scalare’s expansion in the US may not be successful in that it is unable to attract sufficient revenue generating opportunities given it is a new entrant and the number of established competitors in the market, the potential impact of any change in US regulations and the availability of resources once the capacity of the existing team is fully utilised. As a result, the funds invested in the establishment of US operations may be lost. In addition, investments made by Scalare are expected to be in businesses that are in growth or early stages of development. The impact on these businesses if risks eventuate may be more pronounced because of their stage of development. Businesses of this nature may not have sufficient operating cash flows to fund business operations and may therefore need additional capital in the future. Scalare may not be able to reliably estimate the likely future revenues, profitability or returns from these investments with any reasonable degree of certainty.

Risks also include new customers, loss of key management, limited trading history and is currently loss making, acquisition implementation, investing in businesses in growth and early stage of development, assets, investments and market risk, due diligence risk, Portfolio companies may not be financially successful or attract necessary capital or Portfolio company founder and key personnel risk.

Section 734(6) disclosure: The issuer of the securities is Candy Club Holdings Ltd (to be renamed Scalare Partners Holdings Ltd) ACN 629 598 778. The securities to be issued are ordinary shares. The disclosure document for the offer can be obtained by clicking on the link above. The offers of the securities are made in, or accompanied by, a copy of the disclosure document. Investors should consider the disclosure document in deciding whether to acquire the securities. Anyone who wants to acquire the securities will need to complete the application form that will be in or will accompany the disclosure document (which can be done via the electronic application form which will become available by clicking the bid button above).