Harvesting the discount from Share Purchase Plans

SPP Harvester

Due to demand, SPP HarvesterTM is not taking any more applications in 2020

Register your interest to join the queue for 2021

Read our blog to see the latest summary providing an overview of upcoming SPPs, current SPP Harvester Applications and past SPPs made available to investors in SPP Harvester.

Key Highlights

Long-term value creation

- Since 1 January 2008, the largest 300 ASX-listed companies have issued 29 SPPs per annum, on average

- Eligible SPP Harvester SPPs issued shares at an average discount of 10% to the closing price on the SPP closing date

Get access to discounted capital raisings

- Retail investors can access SPPs, but not placements

- The SPP price is usually the lower of the placement price or a discount to a 5-day VWAP to the closing date

- SPP HarvesterTM creates a 1-share portfolio in 300 companies to enable access to SPPs

Key benefits of SPP HarvesterTM

- Establishment costs of SPP HarvesterTM are a fraction of do-it-yourself costs

- Automatically reserves an equal proportion of your cash balance where SPP offer periods overlap

- Automatically identifies and applies for in-the-money SPPs

- Automatically excludes out-of-the-money SPPs

- Automatically sells new SPP shares to efficiently recycle investor capital

- Supervised by a trusted custodian and deployed via a leading, robust clearing broker

- SPP HarvesterTM Investors can download an annual statement to make tax time easier

- SPP HarvesterTM does all the work; no ongoing admin for investors

Why now?

- The COVID-19 pandemic is causing a wave of discounted capital raisings

- In 2020, the largest 300 operating companies listed on ASX:

- undertook 60 share purchase plans (SPPs)

- issued A$4.7 billion of new shares and units

- eligible Harvester SPPs were an average discount of 10% to the price on the closing date

What is SPP Harvester?

SPP HarvesterTM is the only automated service which allows you to harvest the discount for Share Purchase Plans undertaken by Australia’s largest 300 listed, liquid, operating companies on ASX (the SPP300).

When an investor account is opened, SPP HarvesterTM automatically buys 1 share in each company in the SPP300. Each share is beneficially registered in your name. Your shares are held by a trusted, globally recognised, custodian, BNP Paribas.

Once you have applied, you will not need to do anything:

- SPP HarvesterTM automatically applies for SPPs, and sells the new shares after they are issued.

- You can increase the amounts that are applied towards each SPP by depositing more funds into your SPP HarvesterTM account at any time.

When an SPP300 company offers shares via an SPP, SPP HarvesterTM analyses whether the SPP is in-the-money at the time of application. An equal amount for each upcoming SPP is provisioned against your cash account, and applications are automatically made for each SPP on your behalf.

If the SPP is oversubscribed, the company may scale-back applications. Alternatively, the company may upsize the SPP so that all applicants receive 100% of their application.

When your new shares are allocated and commence trading, SPP HarvesterTM automatically sells the new securities, using algorithms to minimise price impact and provide best execution. The net sale proceeds are then returned to your cash account, ready for the next SPP.

This allows you to efficiently harvest any discount and efficiently recycle capital through SPPs.

What are the benefits of using SPP Harvester?

SPP HarvesterTM allows you to participate in SPPs undertaken by Australia’s largest ASX listed, liquid companies with a minimum capital outlay and relatively low establishment costs.

To create a 1-share portfolio in 300 entities, a “do-it-yourself" investor would need to buy the minimum market parcel of $500 in every listed entity (ie. $150,000 of buy orders). Selling down that $150,000 portfolio to one share in each company would require another 300 sell orders worth ~$146,500. "Do-it-yourself" investors would be charged brokerage twice: on both the buy order and the sell order.

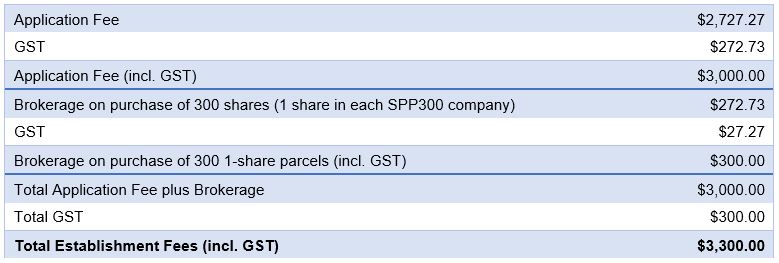

Using an internet broker with minimum brokerage of $15 per trade, a “do-it-yourself" investor would incur transaction fees of ~ $9,000 to establish a 1-share position in 300 listed companies. By comparison, SPP HarvesterTM costs $3,000 (ex GST) to establish a 1-share position in each company in the SPP300.

SPP HarvesterTM removes the hassle of establishing the portfolio and monitoring whether an SPP is in-the-money, determining how much to apply for, and selling down the new shares, to recycle capital into the next SPP.

SPP HarvesterTM only sells the new shares issued under each SPP. By retaining one share in the company, post-SPP sell-downs, this means SPP HarvesterTM will continue to automatically apply for any SPPs conducted by that company in future years.

SPP HarvesterTM enables you to generate on-demand, fully customisable reports for both time-weighted performance and money-weighted performance. Performance reports exclude the application fee.

SPP HarvesterTM investors can also download an annual statement to make tax-time easy.

About Share Purchase Plans

Share purchase plans are a commonly used method of capital raising. Under an SPP, each shareholder is typically offered the opportunity to apply for up to $30,000 in new securities. Typically:

- Shareholders may apply in fixed dollar parcel values in increments of $1,000 or $2,500

- The company may set a cap on the total number of shares available. If the SPP is oversubscribed, then applications can be scaled back

- The price of the shares are generally but not always, set as the lower of:

- the price offered to institutions in the placement; or

- a ~2-3% discount to the 5-day volume-weighted-average-price leading up to the SPP closing date.

Typically, SPPs are open for approximately three weeks. SPP HarvesterTM applies for SPPs several days prior to each SPP closing date.

The chart shows the average discount to the last traded price on the closing date of SPPs, for those SPPs that met the ‘in-the-money’ qualifying criterion used by SPP HarvesterTM in the years since the Global Financial Crisis.

Purchase Price

On the opening date of this offer, the purchase prices of 1-share in each company in the SPP300 collectively added up to ~$3,700. The exact amount will depend on the trading prices at the time of purchase. Investors must pay the purchase price to acquire 1-share in each company in the SPP300 in addition to the Establishment Fees set out below.

Fees and Costs

Establishment Fees of SPP300

Concessions for Early Adopters

Each investor in this tranche is deemed to be an Early Adopter and will receive concessions to allow for a change of heart, and to guarantee that profits from SPPs in the first 12 months will exceed the Application Fee.

If an Early Adopter terminates their participation in SPP Harvester (and has not made a withdrawal that reduces the cash balance below $4,999):

- within 100 days, at the investor’s election; or

- within 1 year, and realised profits on the sale of SPPs do not exceed the $3,000 Application Fee (incl. GST),

then the Manager will:

- reduce total brokerage on the sale of all of the investor’s 300 holdings to $300 (incl. GST) and remit the net sale proceeds to the investor; and

- refund the shortfall, if any, between the Early Adopter’s realised profits on the sale of SPPs and the $3,000 Application Fee (incl GST).

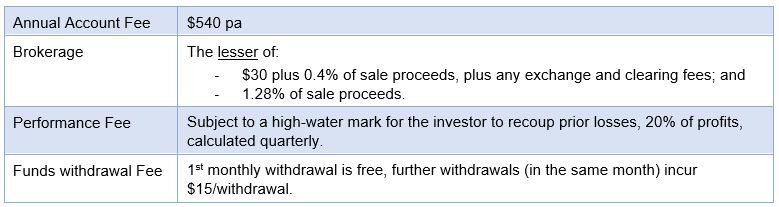

Ongoing Costs

Invoicing

The Manager will provide a separate invoice for the Application Fee. Investors should seek their own taxation advice whether the $3,000 Application Fee is tax deductible in the financial year of application.

The trade report will itemise the $300 brokerage against each purchased share to assist investors to calculate the CGT cost base of each share in the SPP300 portfolio.

Risks

General Risks associated with investing

Prospective investors should be aware that investing in securities and the SPP HarvesterTM strategy involves various risks. There are general risks associated with owning securities in publicly listed entities. The price of securities can go down as well as up due to factors outside the control of the Manager. These factors include Australian and worldwide economic and political stability, natural or man-made disasters, performance of global stock markets, pandemics, interest rates, foreign exchange, taxation, labour relations, environments internationally and other matters outside of the control of the Manager.

SPP strategy risk

SPP HarvesterTM only acquires securities in an SPP that are in-the-money when measured against the opening price on the date that SPP HarvesterTM applies for an SPP on your behalf.

The main risk that investors face is that the market price falls between the SPP HarvesterTM Acceptance Date and the date that your SPP securities are sold. If the price, less any transaction costs, realised on the sale of the SPP securities is less than the SPP Price, the investor will realise a loss.

Listed entities in the SPP300 may experience a decline in liquidity which means that the SPP securities cannot be sold without having a negative impact on the market price of the securities.

A lack of Share Purchase Plans

Listed entities may choose not to undertake SPPs when they raise capital. SPP HarvesterTM carries an annual fee, and if listed entities in the SPP300 do not undertake SPPs or entities in the SPP300 undertake substantially fewer SPPs than the average number of SPPs over the last 12 years, investors may not recover their annual costs or the establishment costs.

No operating or performance history

SPP HarvesterTM is a new offering without operating or performance history and no track record which can be used by investors to make any assessment about the offering. Investors should be aware, that the number, frequency, and pricing of past SPPs may not be a reliable indicator of the number, frequency, and pricing of SPPs that will be accessed via SPP HarvesterTM. Past performance is not a reliable indicator of future performance.

Oversubscribed SPPs with disadvantageous scale-back

Share Purchase Plans in the SPP300 may be oversubscribed and listed entities may choose scale-back methods that are disadvantageous to SPP HarvesterTM investors, reducing the number of securities issued to investors.

Regulatory Risk

Regulations may be changed in a way that reduces or eliminates the potential returns for investors in the SPP HarvesterTM service. In the event of a material adverse regulatory change affecting the Manager or Investors, the Manager has a right to terminate SPP HarvesterTM. Termination will result in transaction costs associated with disposal of the SPP300 and this may result in investors not recovering their investment.

Please see detailed information about SPP HarvesterTM in the booklet.

Important Notice and Disclaimer

This publication provides general information about the SPP HarvesterTM service. The information in this booklet is provided by OnMarket Investment Management Pty Ltd (ABN 81 614 343 814 | AR No. 1281569), an authorised representative of On-Market Bookbuilds Pty Ltd (ABN 31 140 632 024 | AFSL No. 421535). OnMarket Investment Management Pty Ltd does not provide investment advice, and information in this publication does not take into account your personal and financial circumstances, needs and objectives. You should consider the appropriateness of the information with regards to your personal circumstances, needs and objectives before making an investment decision.

OnMarket Investment Management Pty Ltd makes no warranties or representations regarding the material in this publication, including those regarding its fitness for any purpose, or any defects or errors. OnMarket Investment Management Pty Ltd is not liable to users of the information for any loss or damage however caused resulting from use of the material herein.

To the extent of any inconsistency between the information set out on this webpage and the attached Terms and Conditions, the Terms and Conditions prevail.

The intellectual property described on this website as SPP Harvester is the subject of Innovation Patent No. 2020101031, granted on 8 July 2020, which is owned by OnMarket Investment Management Pty Ltd.

OnMarket Investment Management Pty Ltd has registered an Australian trademark application in respect of SPP HarvesterTM.

The OnMarket logo is a registered an Australian trademark of On-Market Bookbuilds Pty Ltd (ABN 31 140 632 024).

Copyright of this material is owned by OnMarket Investment Management Pty Ltd (ABN 81 614 343 814).

Apply

Your SPP HarvesterTM application process will be simpler and processed more quickly if you register in your individual name, rather than investing via an SMSF, trust or company (as these will require you to send certified copies of constituent documents by mail).

Applications by individuals are fully-electronic.

Company Releases

Financial Services Guide 20 Aug 2020Discover investment opportunities here.