Transforming NDIS housing solutions for people with disabilities, backed by a 98% client satisfaction rate

Open for Investment Second Home NDIS (8Care P/L)

8Care Pty Ltd Equity Crowdfunding

Min reached. Now targeting $500k

$135,250

Raised39

InvestorsPlease consider the offer document and general risk warning before investing.

Investors are entitled to a 5 day cooling-off period.

Investments over $10,000 are restricted to Sophisticated investors - Apply here

Click here to learn more about Equity Crowdfunding

Join the Second Home NDIS journey

Second Home NDIS creates custom short-term stay and long-term housing solutions for people with disabilities. Backed by a 98% satisfaction rate, FY23 revenue of $4.9 million and a profitable business model we are redefining disability services in Australia by combining care and innovation.

Empowering Lives, One Home at a Time

Second Home NDIS mission goes beyond care - creating homes and lasting happiness for individuals with disabilities. As we embark on our next phase of growth, we invite you to become part of a movement that’s redefining disability care in Australia.

Your Investment, Their Happiness

By investing in Second Home NDIS, you’re not just contributing to a business poised for significant growth; you’re supporting a cause that makes a real difference in people’s lives. Every investment helps us expand our reach, develop innovative solutions, and create more ‘Second Homes’ that bring joy and independence to our clients.

Be Part of Something Bigger

This is more than a fundraising campaign; it’s an opportunity to join a community dedicated to making a positive impact. Your investment will fuel our growth, enabling us to touch more lives and redefine what’s possible in disability care.

Why we like Second Home NDIS

- Personalised NDIS care: Second Home NDIS creates personalised living experiences for people with disabilities through custom short-term stays and long-term housing solutions, emphasising individual preferences and a "holiday-like" atmosphere.

- Proven success: Founded in 2019 the company now operates 17 properties across Victoria, over 62 employees, assisting over 300 individuals annually and boasting a 98% customer satisfaction rate.

- Profitability and growth: Revenues of $4.9m in FY23, a 158% Compound Annual Growth (CAGR) increase from FY19. Second Home NDIS achieved profitability in FY23, recording a net profit before-tax of $209k.

- Significant Potential: Targeting a 300% revenue increase over 24 months via 60 new long-term housing clients, with over 15 already in the pipeline.

- Growing NDIS funding: The NDIS budget is in excess of $41.9 billion and its proportion of GDP is projected to increase from 1.48% in 2023 to 1.93% by 2033, a 30.4% increase in real funding. Over 25% of NDIS payments will be received by participants in Supported Independent Living.

- Strategic expansion: With ongoing growth in demand, the Company has significant growth potential with plans to enter New South Wales and Queensland, catering to over 50% of Australia's active NDIS participants.

Empowering lives: Unlocking disability care potential

In Australia, the disability sector is at a turning point. With over 4.3 million Australians living with a disability, the need for innovative, personalised care solutions has never been more critical.

Enter Second Home NDIS, born from a vision to transform the landscape of disability care. Our founders, leveraging their deep insights from working within the NDIS since its rollout, identified a significant gap: the lack of truly 'home-like' accommodations that cater to individual needs and aspirations.

From a modest start in 2019, we have built a business supporting over 300 people with disabilities each year, across 17 customised properties with a team of 62 employees. This success has resulted in revenue of $4.9 million and net profit before-tax of $209k for FY23.

With the NDIS budget set to increase, reflecting a growing commitment to supporting those with disabilities, Second Home NDIS stands at the forefront of this evolving sector, ready to expand our impact and continue redefining what it means to offer support in the disability community.

Transformative disability care: Our services unveiled

Second Home NDIS provides personalised living experiences that promote independence, joy, and a sense of belonging – redefining disability care with personalised accommodation solutions that create a true sense of home.

We offer both short-term respite and long-term living arrangements, tailored to the unique needs and preferences of each NDIS participant. Our accommodation range from serene retreats for short stays to customised long-term residences, all designed with the individual's well-being in mind.

This commitment to personalised care is reflected in our 98% satisfaction rate and supported by a team dedicated to compassion, innovation, and excellence.

At the forefront of disability care, Second Home leverages the latest technologies and sustainable practices to continuously improve our services. Join us on our mission to transform lives, one individual at a time.

Expanding horizons in disability care market

With very few opportunities to become part of this rapidly growing sector, Second Care NDIS represents a unique investment.

Second Home NDIS stands at the forefront of an expanding disability care market, driven by increasing awareness and supportive NDIS funding. With the NDIS budget now exceeding $40 billion, and over 50% of NDIS allocations directed towards NSW and QLD, our strategic expansion into these regions presents an unprecedented opportunity.

The upcoming NDIS reforms, which mandate registration for all providers, present a watershed moment for the industry. With a nationwide shortage of appropriate accommodations, we expect the reforms may significantly increase demand for Second Home NDIS’s services as we aim to bridge this gap with our innovative housing solutions.

Proven success and rapid growth trajectory

Second Home NDIS's journey is marked by remarkable achievements and a steadfast upward trajectory. Since our inception in 2019, we've seen exponential revenue growth, soaring from a modest start to an impressive $4.9 million in FY23, with significant ongoing growth potential in the rapidly growing NDIS market.

Our high client satisfaction rate of over 98% underscores the impact and quality of our services. With 17 properties under our management and a growing portfolio of both short-term and long-term accommodations, our expansion is a testament to our ability to meet and exceed the evolving needs of our community.

This sustained success is not just a reflection of our past but a solid foundation for our future endeavours.

Distinctive edge in disability care services

At Second Home NDIS, our competitive advantage lies in our deeply personalised approach to disability care. Unlike traditional providers, we create homes, not just accommodations, tailoring every aspect to the individual's needs and preferences. This bespoke service, combined with our commitment to building lifelong relationships with clients and staff, sets us apart in the sector.

Our innovative use of technology, including AI and smart home features, enhances the living experience and operational efficiency. With a dedicated team that brings expert NDIS knowledge and a compassionate touch, we offer an unmatched level of care that has earned us a 98% satisfaction rate.

Our strategic expansion into key regions, backed by robust NDIS funding, positions us as leaders in redefining disability care in Australia.

Invest with your head and with your heart

As an investor in Second Home NDIS, you become an integral part of a journey that transforms lives. Each month, we bring you closer to the heart of our mission through exclusive emails showcasing the happy moments and success stories of the individuals we serve.

These stories are a testament to the positive change your investment could facilitate, offering a glimpse into the lives enhanced by our services. It's not just about seeing the growth of your investment; it's about witnessing the direct impact it has on making someone's life a little brighter.

Join us, and be rewarded with the knowledge that your contribution is truly making a difference, one life at a time.

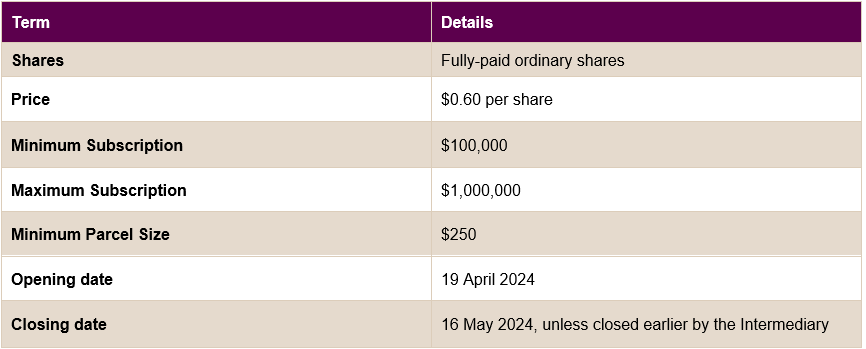

Terms of the Offer

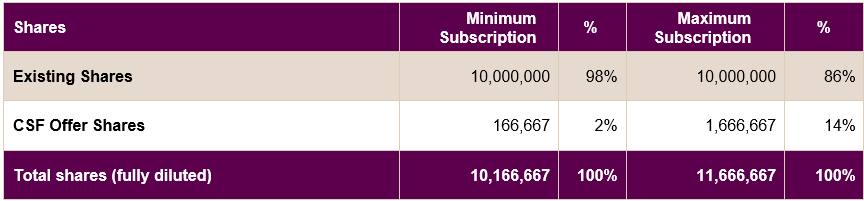

Issued Capital

For more detailed information, please read the Capital Structure section of the offer document.

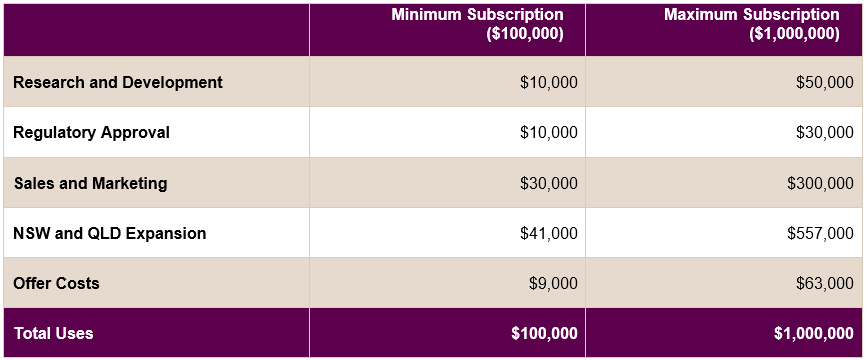

Use of Funds

For more information, please read the Use of Funds section of the offer document.

Company Risks

8Care Pty Ltd is redefining disability service in Australia by providing high-quality, personalised accommodation and care services for people with disabilities. As with any growth business, an investment in the Company should be seen as high-risk and speculative. A description of the main risks that may impact their business are listed in the offer document. Investors should read this section carefully before deciding to apply for shares under the Offer. There are also other, more general, risks associated with the Company (for example, regulatory and funding risk, legal and regulatory risk, NDIS audit compliance, insurance coverage or the inability to sell their shares). See the Risk section in the Offer Document for further information.

The Offer is subject to a Maximum Subscription amount of $1 million. If the Maximum Subscription is reached, the Offer will close early. Applications will be treated on a time priority basis and may be subject to scale back, so please fund your application as soon as possible.

RISK WARNING: Crowd-sourced funding is risky. Issuers using this facility include new or rapidly growing ventures. Investment in these types of ventures is speculative and carries high risks. You may lose your entire investment, and you should be in a position to bear this risk without undue hardship. Even if the company is successful, the value of your investment and any return on the investment could be reduced if the company issues more shares. Your investment is unlikely to be liquid. This means you are unlikely to be able to sell your shares quickly or at all if you need the money or decide that this investment is not right for you.

Even though you have remedies for misleading statements in the replacement offer document or misconduct by the company, you may have difficulty recovering your money. There are rules for handling your money. However, if your money is handled inappropriately or the person operating this platform becomes insolvent, you may have difficulty recovering your money. Ask questions, read all information given carefully, and seek independent financial advice before committing yourself to any investment.

5 DAY COOLING OFF PERIOD: There is a 5 business day cooling off period for retail investors. During this period, you may withdraw your application and receive a full refund into your nominated refund account. Please note: After the 5 day cooling off period has expired, you will be unable to withdraw your application. More information here.

ONMARKET FEES: Upon successful completion of the Offer, a maximum fee of 6.0% of the funds raised will be paid to OnMarket by the Company.

ONMARKET INTERESTS: OnMarket and its associates may be participating in this offer.

ONMARKET INTERESTS AND AMOUNTS SUBJECT TO COOLING OFF: The funding bar displayed under each crowd funding offer may include applications where payments are yet to be made and amounts that are subject to the cooling off period.

Section 734(6) disclosure: The issuer of the securities is 8Care Pty Ltd ACN 634 118 657. The securities to be issued are fully-paid ordinary shares. The disclosure document for the offer can be obtained by clicking on the link above. The offers of the securities are made in, or accompanied by, a copy of the disclosure document. Investors should consider the disclosure document in deciding whether to acquire the securities. Anyone who wants to acquire the securities will need to complete the application form that will be in or will accompany the disclosure document (which can be done via the electronic application form which will become available by clicking the bid button above)

Discover investment opportunities here.

Question time

We'd love to answer your questions, we'll have one of the OnMarket team or the company representative of the offer get back to you asap. So ask away ...

I find the Offer terms a little confusing. Investments over $10,000 are restricted to Sophisticated investors. Minimum subscription for this offer is $100k and then minimum parcel is $250. So a minimum investment of $100k gets 166,666.67 shares? And this is targeting sophisticated investors only?

PP C (OnMarket member) on 23/04/2024Hi PP,

Carla L (OnMarket staff) replied to PP C on 23/04/2024Thanks for your question.

The minimum offer size (minimum subscription)is $100k, and the maximum offer size is $1 million.

You can invest as little as $250 to purchase shares in Second Home NDIS (the minimum parcel size) but to invest more than $10,000 you need to qualify as a sophisticated investor.

I hope that clears up any confusion.

the statement of position only shows $100 as capital equity. The capital structure shows 10 million issued shares. please explain how this came about and any related consequences?

nick c (OnMarket member) on 23/04/2024Am i buying shares in the parent company or the Subsidiary company?

Hi Nick

Nick M (OnMarket staff) replied to nick c on 23/04/2024Thanks for your question. Prior to the offer, 8care Pty Ltd had 100 fully paid shared with paid up capital of $100. In preparation for this offer the company undertook a share split to create 10,000,000 shares which are valued at $0.60 each to create a pre-money equity value of $6 million.

As detailed on page 18 of the offer document, under this offer you are acquiring shares in 8care Pty Ltd which is the parent company with one subsidiary.

Please sign in to post a question